Superannuation Contribution Caps

Are you maximising your retirement savings potential? Outside of relying on investment returns, the best way to ensure that your retirement assets grow over time is through superannuation contributions. With the Australian government’s recent announcement regarding the changes to superannuation contribution caps in 2024, understanding and adapting to these updates is crucial for anyone looking to secure a financially stable retirement. There are two main types of contributions – concessional and non-concessional.

Concessional Contributions

Concessional contributions are before-tax payments into your super fund, including employer contributions and any personal contributions you claim a tax deduction on. They’re taxed at a low rate of 15%, making them an efficient way to grow your retirement savings. The annual limit on these contributions caps the tax-advantaged amount you can contribute.

Non-Concessional Contribution

Non-concessional contributions are made with after-tax income and aren’t taxed again upon entering your super fund. These contributions are subject to a higher annual cap, allowing you to significantly increase your retirement savings without additional tax implications. Both contribution types are essential for strategic retirement planning, offering different advantages to enhance your super balance effectively.

Non-Concessional Bring-forward Rule

The non-concessional bring-forward rule in Australian superannuation allows individuals to make up to three times the annual non-concessional contributions cap in a single year, spreading the total over a three-year period without incurring extra tax. This rule is designed to help individuals boost their super savings more significantly and flexibly, especially after receiving large sums of money.

Key Changes from 1 July 2024:

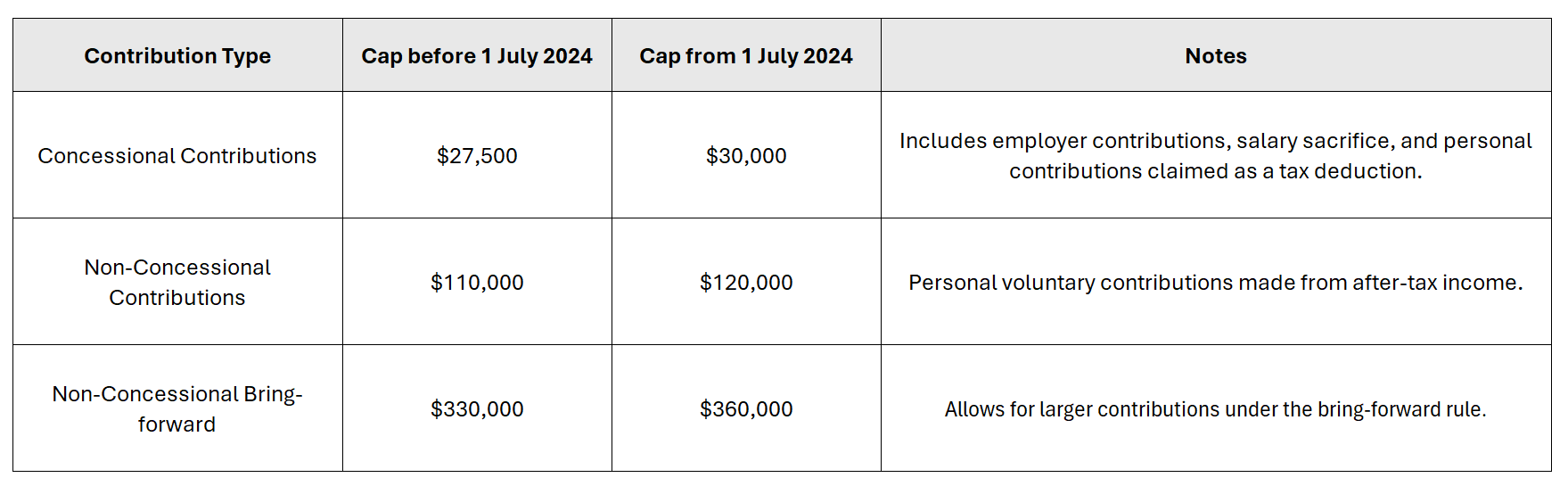

The Australian Government, following the latest Average Weekly Ordinary Time Earnings (AWOTE) data release, has announced an update to the superannuation contribution caps, effective from 1 July 2024. The following table outline what’s changing:

Superannuation Contribution Caps Changes

NOTE: It important for individuals aged 67 and over to meet a work test or qualify for an exemption to claim these deductions.

If you’re already making voluntary personal contributions and claiming them as tax deductions, the upcoming increase in the concessional contributions cap could lead to more substantial deductions and, therefore, greater tax savings for you.

With the 2024 changes set to impact your superannuation contributions, now is the perfect time to assess and adjust your retirement planning strategy. At MKG Partners, we’re prepared to help you understand these tax changes. Our expertise can provide clarity on the tax considerations you should be aware of during your retirement planning process.