Super Contribution Caps 2025: Key Points to Keep in Mind

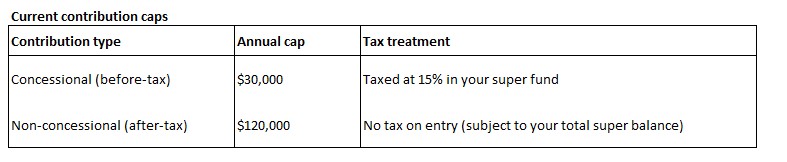

With the higher super contribution limits now in place, it’s a good time to revisit what the current caps are and how they apply this financial year. From 1 July 2024, both the concessional and non-concessional caps increased for the first time in three years, providing greater flexibility for those looking to grow their retirement savings through superannuation.

These caps apply for the 2024–25 and 2025–26 financial years unless further changes are announced.

A quick recap on how the caps work

Concessional contributions

These include employer Super Guarantee payments, salary-sacrifice contributions, and personal deductible contributions. If your total concessional contributions across all funds exceed the annual limit, the excess is taxed at your marginal rate, with an offset for the 15% already paid by your fund.

The carry-forward rule allows eligible individuals to use unused concessional caps from the past five years, provided their total super balance is under $500,000. This can benefit those who had lower contributions in previous years and want to make additional contributions later.

Non-concessional contributions

These are voluntary contributions made from after-tax income. You can contribute up to $120,000 per year if your total super balance is under $1.9 million (as at 30 June 2024). It’s important to check this balance before contributing, as exceeding the limit may result in additional tax.

The bring-forward rule allows individuals under 75 to contribute up to three years’ worth of non-concessional contributions in one year. With the current limits, that’s up to $360,000 at once, provided your total super balance is below the threshold.

See ATO Super Contribution Caps for more details

Why review your position now

The new caps have been in place since July 2024, but many super fund members have yet to adjust their contribution levels. Checking where you stand now—well before 30 June 2026—can help ensure your contributions remain within the limits and align with your broader retirement goals.

If you are unsure about your current contributions or eligibility for these rules, it’s best to review this with your super fund or financial adviser.

Key points to remember

- Current caps: $30,000 (concessional) and $120,000 (non-concessional).

- Bring-forward rule: up to $360,000 in one year (if eligible).

- Carry-forward rule: use unused concessional caps from the past five years (if balance under $500,000).

- Check your total super balance before making after-tax contributions.

- Speak with your fund or adviser if you’re unsure how the limits apply to you.

Your superannuation is one of your most important long-term investments. A smart choice today will support your financial security in the years ahead. At MKG Partners, we work closely with Brad Martin and Vy Nguyen from Blueprint Wealth, licensed financial advisers who provide clear and independent guidance. They can help you understand your options with confidence and make informed decisions about your retirement savings. If you would like to be connected with Blueprint Wealth, please contact us and we can introduce you.