Hiring New Employees

Hiring a New Employee

Is your business currently in the process of hiring a new employee? Read on for our handy tips – we have all the links to help you find what you need fast!

Know the law

Before hiring a new employee, employers need to make sure they know their rights, responsibilities and obligations – whether they relate to pay, minimum terms and conditions, tax or superannuation. There is a lot you need to know about hiring employees. A good place to start to guide you through the hiring process and understand your many employer obligations, including tax and superannuation, visit www.business.gov.au – Hiring employees

Four Steps

Only four steps? Sounds easy, but the preparation for a new employee will take plenty of time – make sure you don’t rush the process! Research, plan, prepare and get it right to save potential problems.

- Determine which industrial relations system your business falls under.

- Determine if your employee is an employee or an independent contractor.

- Determine if your employee is full-time, part-time or casual

- Research employment conditions and ensure you meet all of your obligations and standards set by law, create an offer of employment and new employment pack.

Once your new employee has accepted and agreed to your offer create your new employee in your accounting app ready for their first pay cycle. Go to our webpage for our handy Xero payroll guide to new employees.

Industrial Relations Systems.

Two different industrial relations systems operate in WA, the state system and the national fair work system. Which System applies to a particular business or organisation and its employees depends on the type of business arrangement under which the employer operates.

Generally the state system includes businesses that are sole traders, unincorporated partnerships, unincorporated trust arrangements. Further information for employing persons under the state system can be found at www.commerce.wa.gov.au .

The national fair work system covers WA businesses that are constitutional corporations. This includes PTY LTD businesses or financial corporations. Businesses employing persons under the national system should visit www.fairwork.gov.au for further information.

Employee or Contractor?

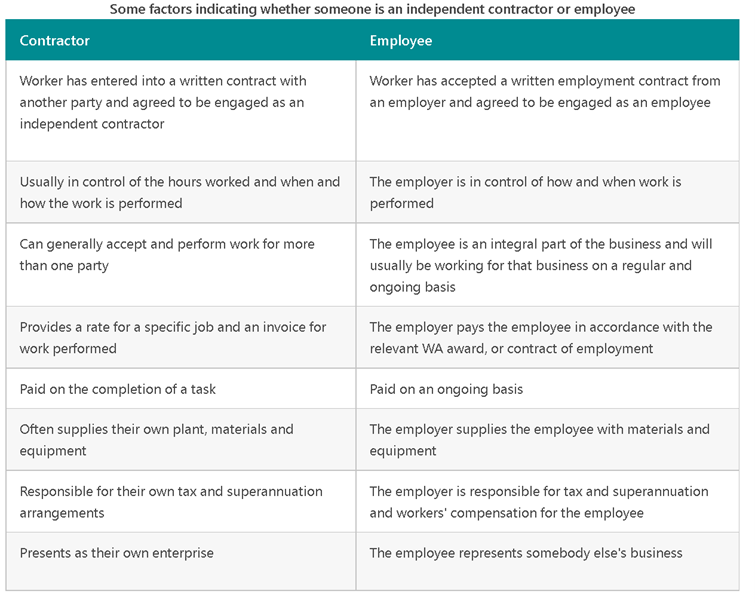

An independent contractor is not an employee but rather a worker running their own independent business. They are often referred to as contractors or subcontractors.

The industrial relations act 1979 prohibits sham contracting. A sham contract arrangement may occur where an employer knowingly disguises an employment relationship by telling an employee that they are being hired as an independent contractor when they are really an employee. Refer to the table to ensure you understand the type of employment agreement you should reach with your new employee.

More information for employers that come under the State System

Handy state system guide for small businesses – Understanding employment obligations under the state system.

Visit their webpage for more information and keep informed on all the latest changes to the state industrial relations laws by subscribing to Wageline News.

More information for employers that come under the National Fair Work Standard

The minimum terms and conditions of employment come from an award, registered agreement and contract of employment, and the National Employment Standards (NES). An employment contract or registered agreement can’t provide for less than what is in the NES.

To find the right award, visit the Fair Work webpage and use their handy tools and calculators. Keep an eye out for the Employment Contract builder, Find my award Tool, Position description template and use the hiring employees checklist to understand what else you need to do when you hire someone.

Subscribe to Fair Work Newsroom for all the latest updates – Subscribe to email updates – Fair Work Ombudsman

Full time, Part Time or Casual?

Employee entitlements vary depending on the type of employment: full-time, part-time or casual.

Full time and part time employees are workers who are in ongoing employment. They work on a regular ongoing basis every week for a set number of hours. Part time employees receive the same wages and conditions as full time employees but on a proportionate basis according to the hours they work.

Full time and part time employees are entitled to paid annual leave, personal leave, bereavement leave and long service leave, as well as up to two days’ unpaid personal leave for caring purposes, five days’ unpaid family and domestic violence leave, and unpaid parental leave.

- State System Businesses go to *page for more information on working hours for full time and part time employees.

- If you operate or are employed by a Pty Ltd business – you can find information on this topic on the * Fair Work Ombudsman

Prepare an offer of employment letter and an employment contract.

Prepare an employment pack

Once you’re happy you’ve got the right details in the offer letter and contract prepare an employment offer pack with:

- 2 identical copies (one for your employee’s records) of the letter of offer and attached employment contract

- the position description, if you have chosen to attach it separately

- the Fair Work information statement (you must give this to all employees, including casuals).

- The Casual Employment Information Statement (you must give this to casuals).

You could also add the following to your employment pack (if you don’t, make sure you provide them when your employee starts):

- a tax file number (TFN) declaration form

- superannuation choice form

- digital or hard copy of the relevant award

- your business policies and procedures.