Hubdoc by Xero

Skip the diet and make one of your new years resolutions to keep your financial records in tip top shape! (This is one resolution we can help you stick to 😊!)

Hubdoc is a great little piece of technology that doesn’t just take a photo of your paperwork for ‘records purposes’ but actually turns your receipts and invoices into data you can use!

Keep reading our article and learn how to save time, reduce errors and keep your accountant happier at year end. Yay! Happy New Year accountants! 🤓🎆

Even better we are happy to add that this technology is included free of charge to any client who has a current Xero subscription and Hubdoc can integrate easily with other accounting software. (ie Quickbooks online)

Hubdoc automatically sorts and organizes all of your documents into searchable and customizable folders as soon as they arrive. No more piles of paper or filing cabinets full of documents.

Three ways to submit to Hubdoc means no matter how you have received your paperwork you can upload to the Hubdoc cloud quickly and easily.

1) Take a photo and submit via an app on your smartphone.

2) Email in to your unique hubdocs address

3) Upload from your desktop computer with ‘click and drag’ or ‘import’ functions

If you need help on how to access the app or get started with uploading please click here and follow our guidelines.

Once you have uploaded your document or receipt to hubdocs the next step is to publish into your accounting software. This is where this technology really comes into play. You can setup rules, setup auto sync so that the software will ‘remember’ how you have previously treated a similar extracted data and pre-fill for your approval.

Sounds impressive, however you still need to have your smarts switched on (no autopilot here please!)

To get you started please follow these step by step instructions that demonstrate how to categorise and publish from Hubdocs to Xero.

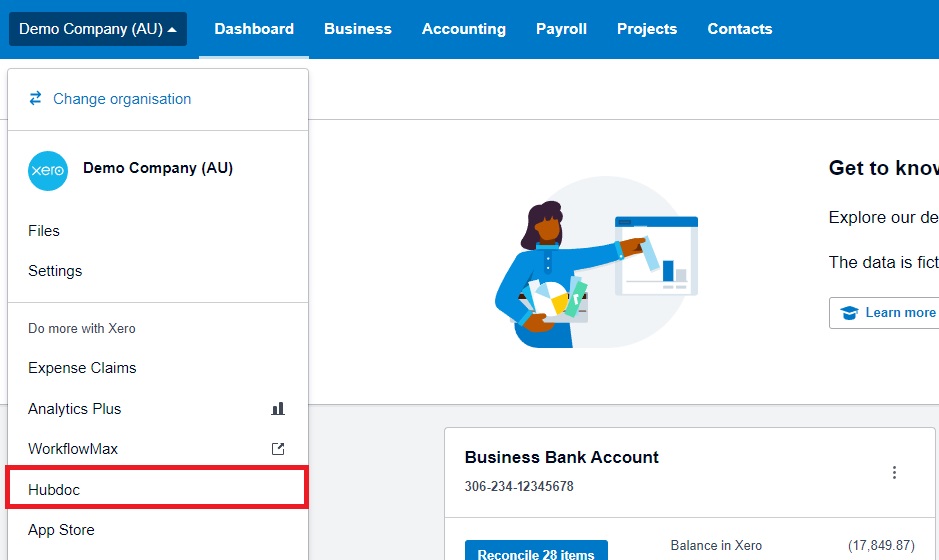

1) Login to Xero, click on your business name in the top left corner of Xero. From the drop down menu, select “Hubdoc”.

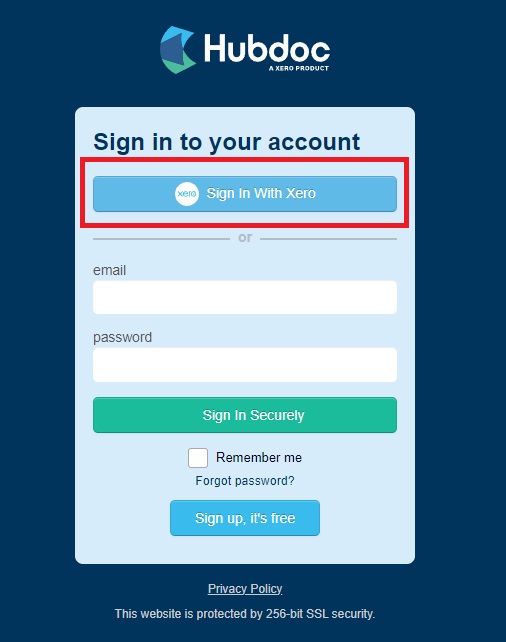

2) A new window will open, click on ‘ sign in with Xero ‘.

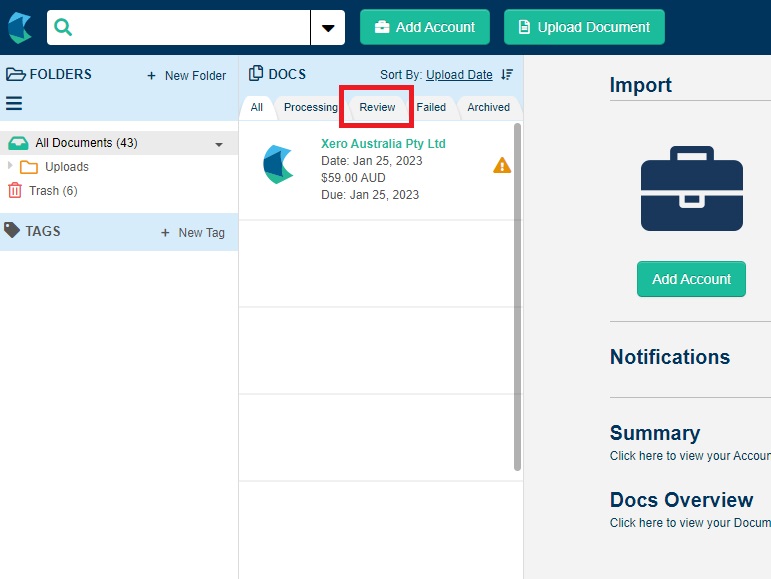

3) From your ‘home’ screen – click on the tab ‘review’, this tab will show only the receipts or invoices that you need to update and publish to Xero.

Keep in mind that you can use hubdocs as a filing system – just click ‘archive’ without publishing and your documents will be stored.

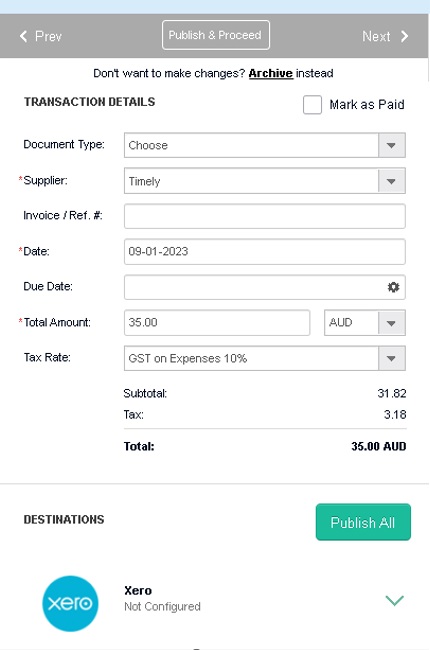

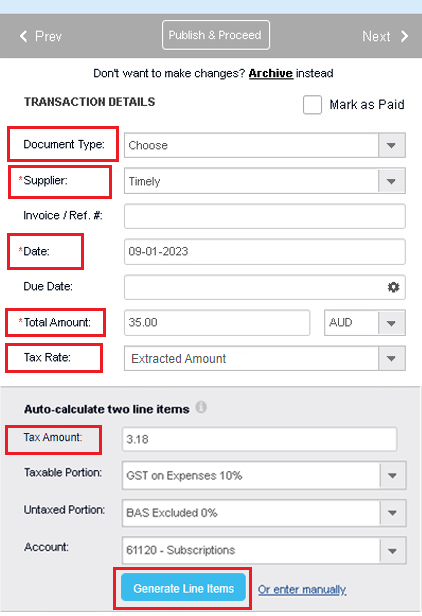

4) Click on the first document/receipt in the list of items to review, then concentrate on the right hand side of your screen to the transaction details area.

5) Work through each detailed area :

- Document type – invoice or receipt

- Tax Rate: extracted amount

- Fill the tax amount in the auto calculate two line area.

- Taxable portion is GST on Expenses

- Untaxted portion is GST free Expenses (it would be BAS excluded if it was personal or a supplier who is not registered for GST)

- Account – Subscriptions (or the particular expense account)

- Click on the green down arrow underneath the publish all button, this opens up an extra field

- Click Generate line items

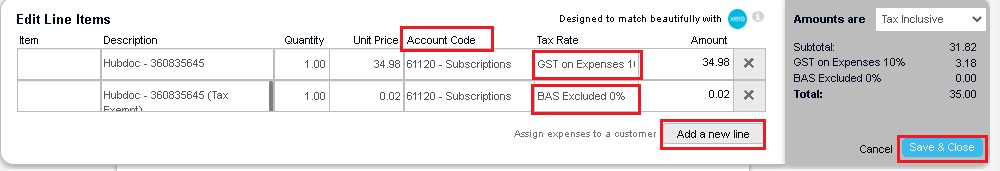

- A new window will pop up – in this box edit each line. This area is designed to allows you to separate one transaction amount into different categories. For example you may have one receipt that has purchases relating to Stationery, Staff Amenities and Cleaning. Add a new line for each category and change the Tax Rate if required.

- Click save and close

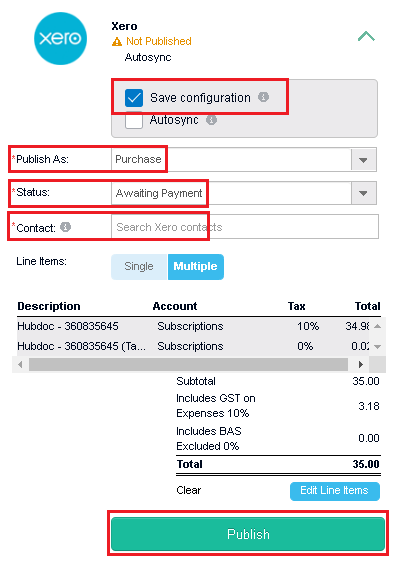

Continue to update each category:

- Tick the box “save configuration” (this will tell hubdocs to remember for next time)

- Publish as awaiting payment

- Enter the contact (ie this example is “Timely”)

- Click on publish

At MKG Partners, we understand the importance of staying on top of your financial records, and that’s why we highly recommend using Hubdoc by Xero. As certified Xero advisors, we can help you integrate Hubdoc with your accounting software and streamline your document management process. Our team of experts can also provide guidance on setting up rules and auto-sync to ensure accurate and efficient data extraction. Contact us today to learn more about how we can help you save time, reduce errors, and keep your financial records in tip-top shape!