2025 – 2026 Tax Changes You Need to Know

As the 2025–26 financial year gets underway, it’s essential for small businesses and sole traders to stay on top of several important changes affecting tax treatment, payroll, superannuation, and compliance obligations. Below is a summary of the latest updates now in effect, along with practical tips to help you stay compliant.

1. ATO Interest Charges No Longer Tax-Deductible

The ATO has confirmed that interest on late lodgements and unpaid tax (such as the General Interest Charge and Shortfall Interest Charge) is no longer tax-deductible for interest incurred on or after 1 July 2025.

-

Any ATO interest incurred on or after 1 July 2025 must be treated as a non-deductible expense.

-

Interest applied to any outstanding tax before 1 July 2025 remains deductible.

What it means: It’s now more costly to carry overdue tax debts. To minimise non-deductible interest, prioritise timely lodgment and payment, or set up an ATO payment plan as early as possible. More details and example at ATO: Denying deductions for ATO interest charges.

2. Superannuation Guarantee Rises to 12%

From 1 July 2025, the Superannuation Guarantee (SG) rate has increased from 11.5% to 12%. This marks the final step in the scheduled rate increases first announced in 2012. Employers must now contribute 12% of an eligible employee’s ordinary time earnings into their super fund.

The 12% rate applies to all salary and wages paid on or after 1 July, even if some or all of the pay period falls before that date. This timing rule can catch some businesses off guard, so it’s important to ensure your payroll system calculates SG based on the payment date, not the work period.

Important: Most payroll systems will update this automatically, but it’s still worth checking your settings. You can use the ATO Super Guarantee Contributions Calculator to check your figures, and refer to the ATO checklist for super success to stay on track.

3. Minimum Wage Increase from 1 July 2025

The Fair Work Commission has announced a 3.5% increase to the national minimum wage, effective from 1 July 2025. This raises the hourly base rate from $24.10 to $24.95.

Employees earning minimum wage can expect to receive approximately $32 more per week, equating to an annual boost of between $1,536 and $1,664.

Payroll tip: Ensure your payroll system is updated with the new minimum wage rate from the first full pay period in July. Visit Fair Work Ombudsman for more detail or download pay guide fora summary of the current minimum pay rates under an award.

Other Notable Updates

PAYG Withholding Cycle Reviews

Businesses may be moved to monthly PAYG withholding reporting if their total annual PAYG exceeds $25,000. You’ll be notified by the ATO if your cycle is changing. If so, adjustments to your software and cash flow planning may be needed. you can read more at the ATO: Changes to your PAYG withholding cycle.

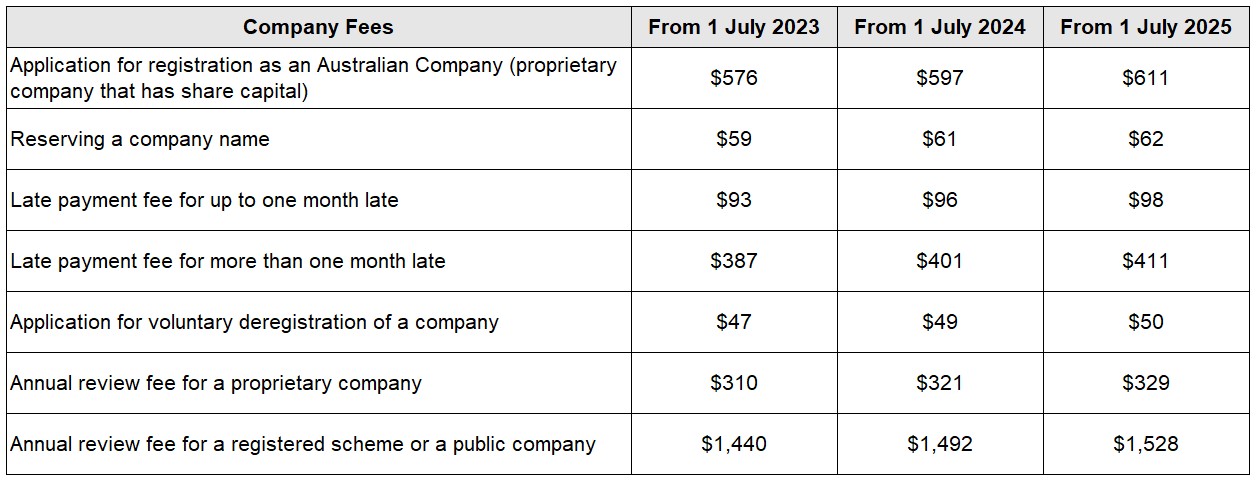

ASIC Fee Increases

The ASIC company registration fee has increased to $611, and the annual review fee to $329. Factor these into your budget if you operate through a company structure.

Full fee listing available at: Asic fees for commonly lodged documents.

Energy Bill Credit for Small Business

Eligible small businesses will receive a $150 electricity rebate, paid in two instalments across 2025. This will appear automatically on your electricity bill. Details are available via Energy Bill Relief Fund.

From payroll updates and SG compliance to navigating ATO deductions and payment schedules, these changes could impact your reporting, cash flow, and strategy. If you’re unsure how any of the above affects your business, now is the time to speak with your accountant. Book a consultation with our team to ensure your systems are aligned and your reporting is accurate for the year ahead.