Assign Billable Expenses: How to Bill Customers for Expenses in Xero

Xero’s Assign Billable Expense function allows you to track expenses that you incur on behalf of a customer or client and then pass those expenses on to the customer by billing them for the expenses. This helps you keep your invoicing process organized and ensures that you are accurately tracking your expenses and revenue.

Here are the simple steps to use the Assign

Billable Expense function in Xero:

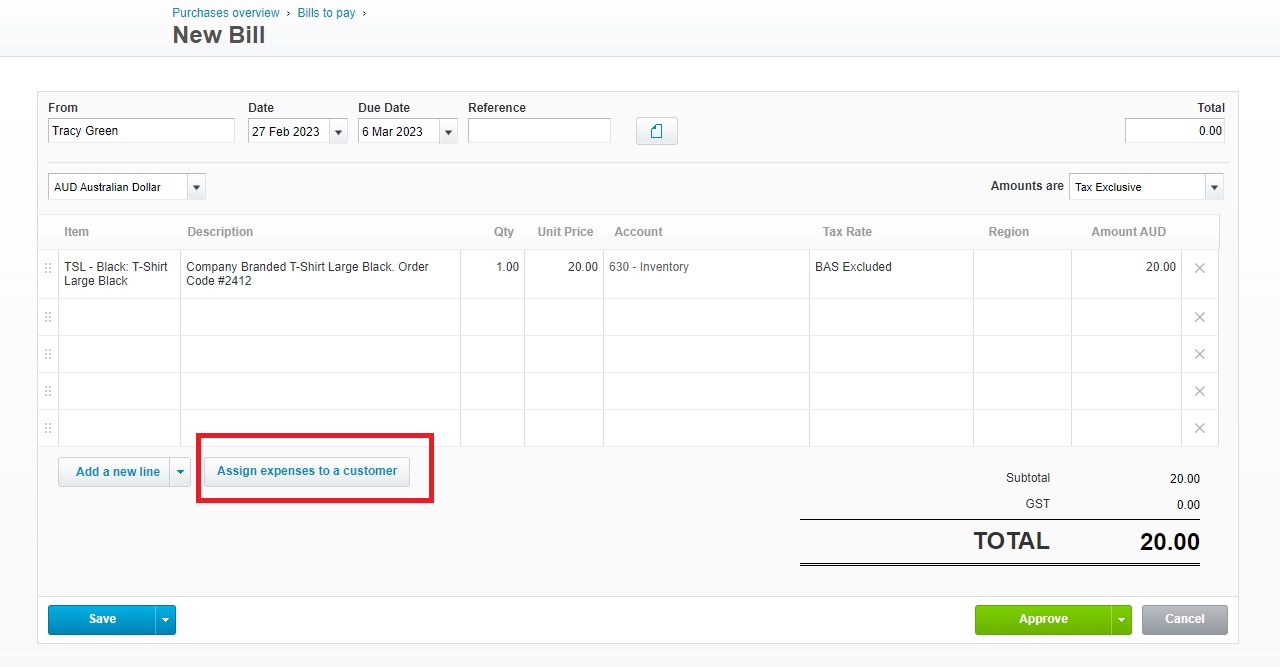

2. Click on the “Options” button at the bottom of the bill and select “Assign to a Customer or Project”.

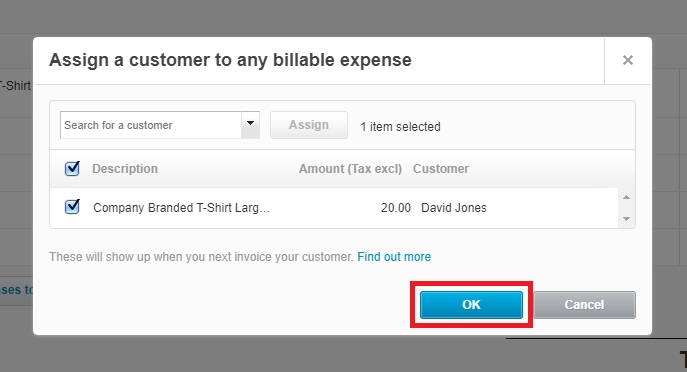

3. Select the customer or project you want to assign the billable expenses to and click ok.

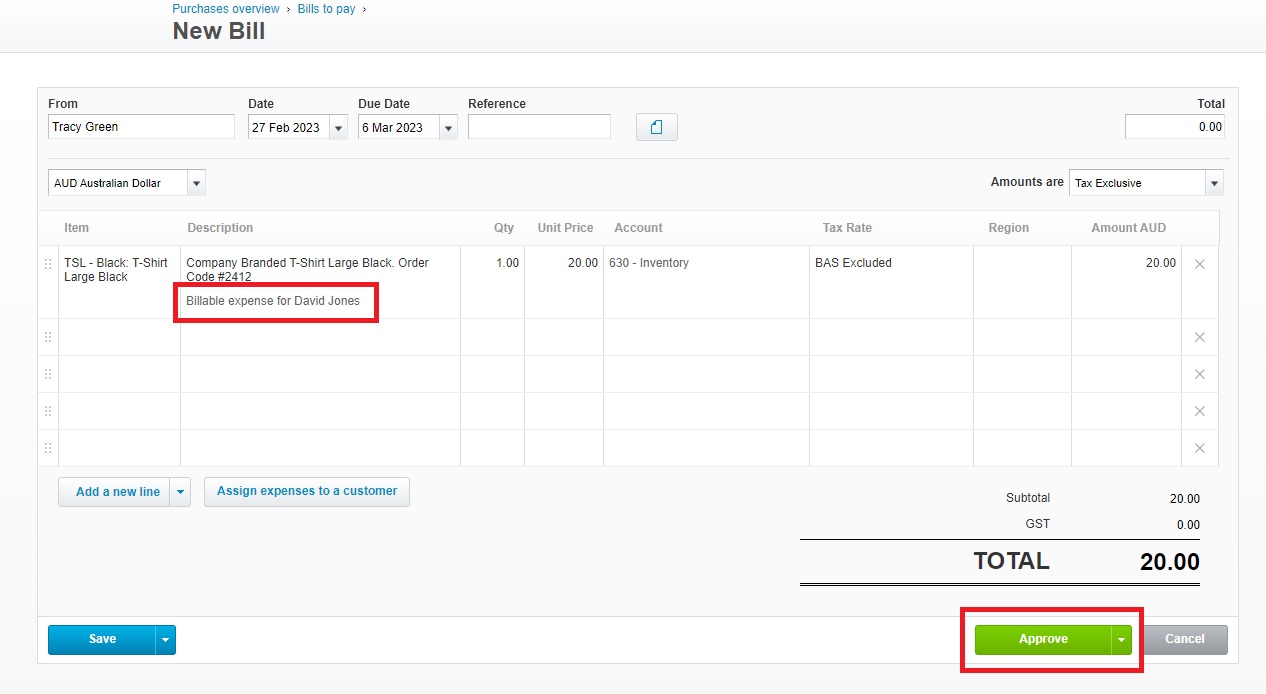

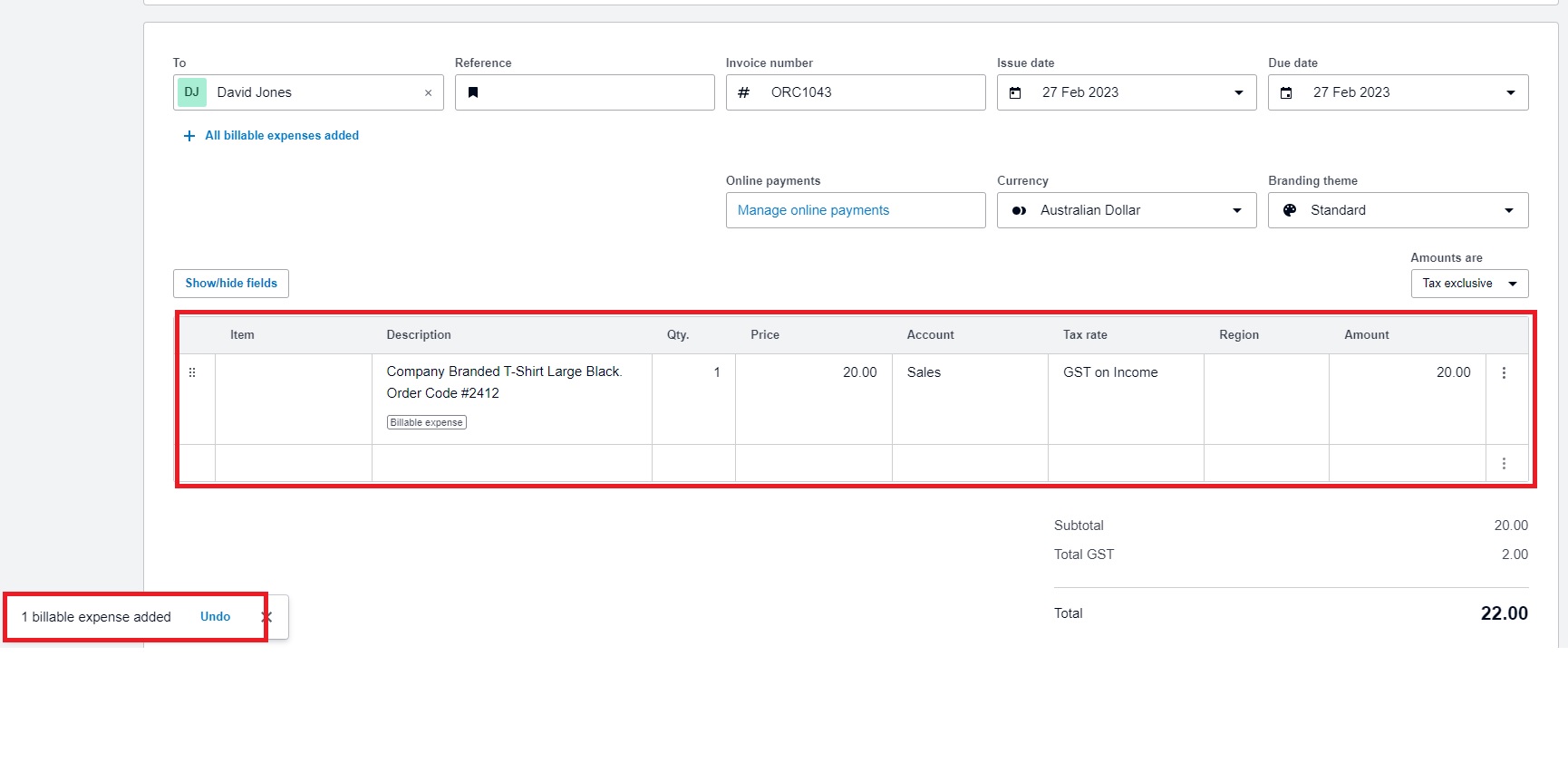

4. Approve the bill, and Xero will track the billable expenses and associate them with the customer or project you assigned them to. You can see the billable expense note right below the description of the item.

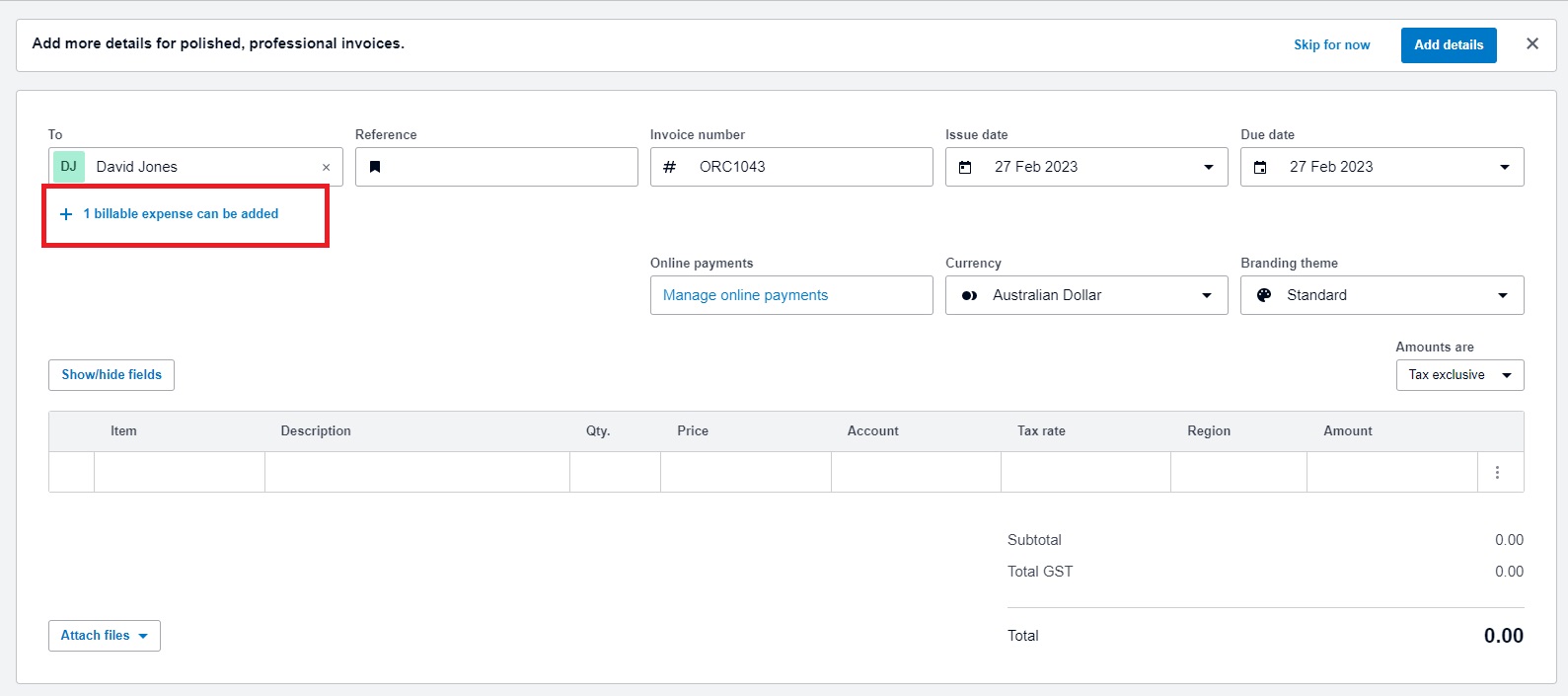

5. Create a new invoice in Xero and select the customer or project you assigned the billable expenses to. The billable expenses will automatically appear as line items on the invoice.

(Note: If the billable expense did not show up, you may re-login into Xero to trigger the prompt)

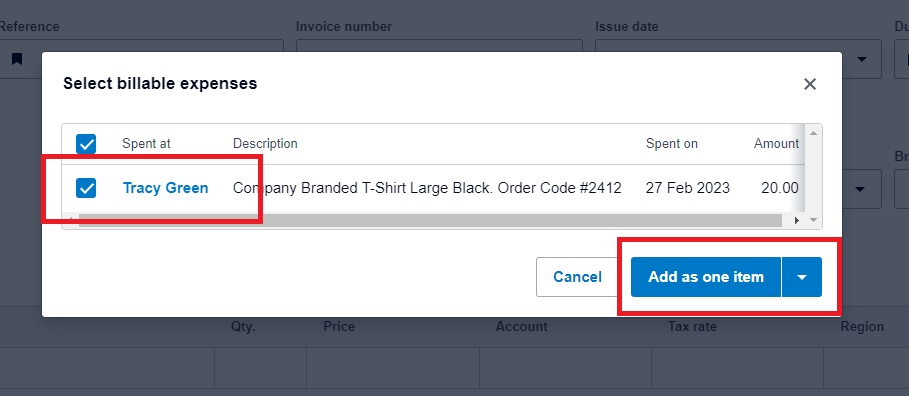

6. Click on the billable expense, then select the item assigned to customer and click on ‘Add as one item’

7. Review and send the invoice to the customer. Xero will automatically apply the payment to the billable expenses when the customer pays the invoice.

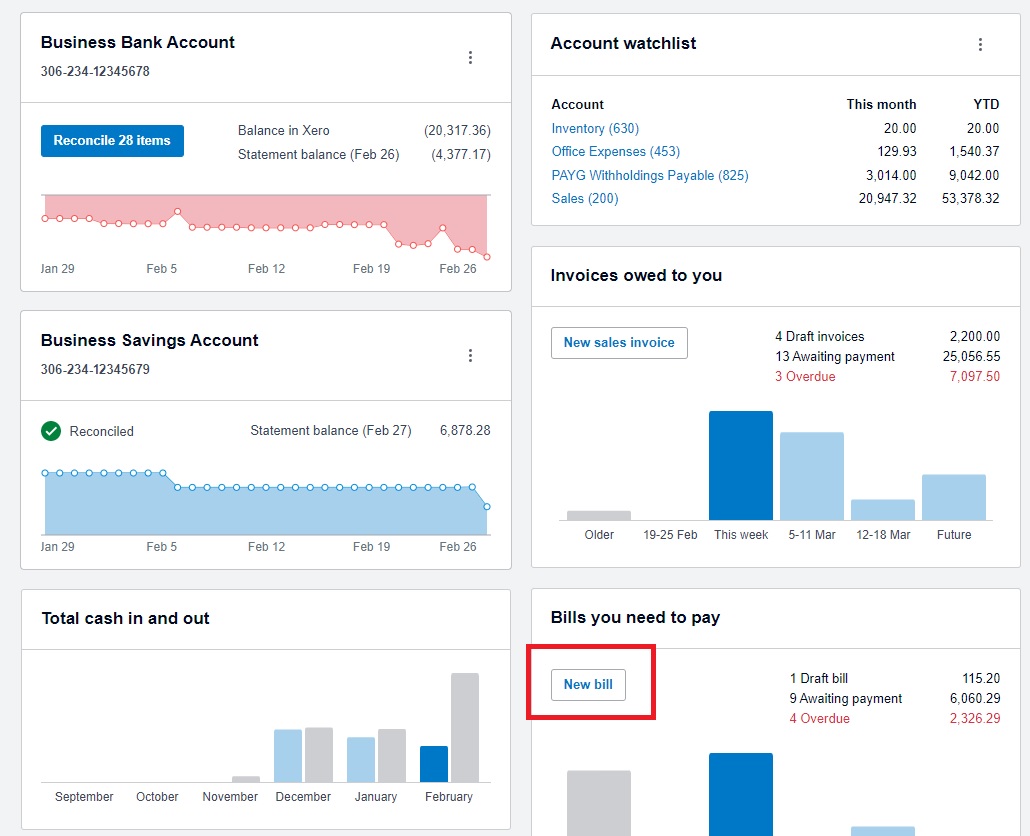

Here’s an example with pictures of how to create

Assign Billable Expenses in Xero:

Key Takeaway:

- Contributing to superannuation is one of the most effective ways to save for retirement in Australia.

- The Australian government provides tax incentives for people to save for retirement by allowing them to make concessional contributions to their superannuation funds.

- Concessional contributions are taxed at a lower rate of 15%, which can result in significant tax savings.

- Carry forward concessional contributions allow individuals to carry forward unused concessional contributions of up to five years before they expire.

- Making carry forward concessional contributions can provide tax planning opportunities and significant tax savings depending on individual circumstances.

- If you have any unused concessional contributions from the 2019 financial year, you need to use them before the end of the 2022/23 financial year, or they will expire.

- To make carry forward concessional contributions contributions, you need to put the cash into your superannuation fund before 30 June and give the fund notice of intent to claim.

2. Click on the “Options” button at the bottom of the bill and select “Assign to a Customer or Project”

(Note: If the billable expense did not show up, you may re-login into Xero to trigger the prompt)

At MKG Partners, we highly recommend using the Assign Billable Expense function in Xero. It’s a great way to accurately track expenses and revenue while making your invoicing process effortless. If you need help setting up Xero or any other accounting-related tasks, don’t hesitate to contact our team of experts. Give the Assign Billable Expense function a try and see how it can help make your life easier!