Business Activity Statement (BAS): From Basics to Best Practices

After our previous blog post on understanding the Goods and Services Tax (GST), it’s time to turn our focus to another important tax compliance obligation: Business Activity Statements (BAS). Knowing how to manage your BAS is a critical aspect of running a small business in Australia. If you are not yet familiar with GST, we recommend reading our comprehensive GST blog first.

What Is a Business Activity Statement (BAS)

Business Activity Statement (BAS) is a tax reporting requirement in Australia that encompasses various types of taxes such as Goods and Services Tax (GST), Pay As You Go (PAYG) instalments, PAYG withholding taxes, and other specific taxes like the Fringe Benefits Tax (FBT) and Fuel tax credits.

Does Your Business Need to Lodge BAS

Not all businesses are required to lodge BAS. If you are registered for GST and your annual turnover exceeds $75,000, you are obligated to submit a BAS.

Note: The ATO typically sends notifications about your need to lodge a BAS either by mail or via their online services portal. These are usually sent automatically before the lodgment due date.

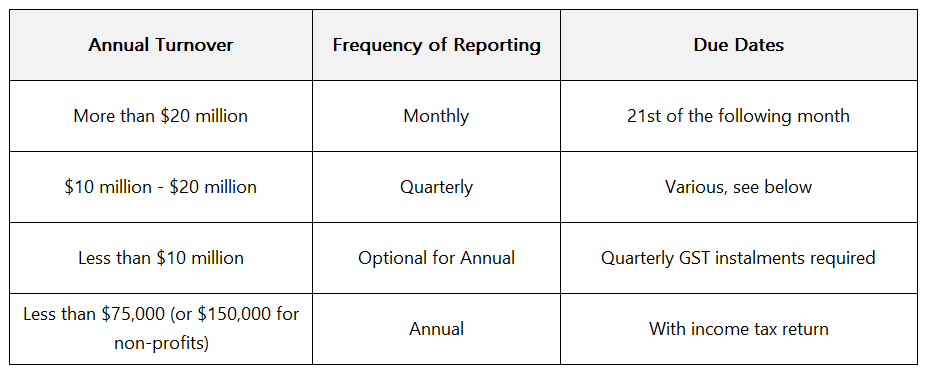

Frequency of BAS Reporting and Due Dates

The frequency of your BAS submission depends on your annual turnover and comes with specific deadlines:

Quarterly BAS Due Dates

- Q1 (Jul, Aug, Sep) – 28th October

- Q2 (Oct, Nov, Dec) – 28th February

- Q3 (Jan, Feb, Mar) – 28th April

- Q4 (Apr, May, Jun) – 28th July

Note: If you lodge your BAS online, you are generally eligible for a two-week extension. If the due date falls on a weekend or public holiday, you have until the next business day to lodge and pay.

Key Components of BAS and Best Practices

1. Goods and Services Tax (GST) Information

What It Is: This is where you record the GST you have collected on your sales and the GST credits you are claiming from your business-related purchases.

Why It’s Important: Accurate reporting ensures you pay the correct amount of GST or receive the right amount of credits. Incorrect calculations can lead to financial penalties.

How to Get It Right: Keep comprehensive records of all your transactions, both sales and purchases, that involve GST. This helps in calculating the net GST payable or receivable for the period.

2. PAYG Withholding

What It Is: If your business employs people, this section is where you report the tax you’ve withheld from their wages.

Why It’s Important: PAYG withholding is a mechanism to collect income tax from workers. Failure to report correctly can result in penalties and disrupt employees’ tax records.

How to Get It Right: Consistently update your payroll system and ensure the tax codes for each employee are correct. Always provide payslips to employees, detailing the withheld amount.

3. PAYG Instalments

What It Is: These are pre-paid amounts towards your expected annual income tax liability.

Why It’s Important: Regular instalments help manage your annual tax liability and avoid a large end-of-year bill.

How to Get It Right: Work closely with your accountant or tax advisor to estimate your annual tax liability based on your income projections and make adjustments as needed.

4. Other Taxes

What It Is: This section is for additional tax obligations your business may have, like Fringe Benefits Tax (FBT), Luxury Car Tax, or other specific industry-based taxes.

Why It’s Important: Ignorance of additional tax obligations can result in unexpected bills and penalties.

How to Get It Right: Be aware of all the tax obligations pertinent to your industry. Consult with tax experts to ensure you aren’t missing any specialised taxes that could apply to your business.

How to Lodge Your BAS

There are multiple options for lodging your Business Activity Statement (BAS). Each has its advantages:

Online Accounting Software: Many businesses use accounting software that has built-in features to lodge a BAS directly with the ATO.

ATO’s Online Business Portal: If you prefer, you can log in to the ATO’s online portal and manually enter your BAS information.

Registered Tax or BAS Agent: If you are unsure about lodging your own BAS or have a complicated tax situation, you can engage a registered tax or BAS agent to handle the lodgment for you.

For a comprehensive guide on self-lodgment methods such as using online accounting software or the ATO’s Online Business Portal, you can refer to the ATO’s official website.

Navigating the complexities of BAS can be daunting, especially for new or small businesses that might not have dedicated accounting departments. At MKG Partners, we offer specialised services tailored to your business needs, taking the hassle out of BAS lodgment. Contact us today for a personalised consultation.