Car Fringe Benefits & Logbooks: How to Save on Tax and Stay Compliant

If your business provides a car for an employee (or even for yourself as a business owner), you might have to pay Fringe Benefits Tax (FBT). But did you know that keeping the right records—like a logbook and odometer readings—could help reduce the tax you owe?

What is a Car Fringe Benefit?

A car fringe benefit arises when an employer makes a business-owned vehicle available for an employee’s private use. This includes:

- Commuting to and from work

- Weekend and holiday travel

- Family and personal trips

Since this is considered a benefit, the ATO applies FBT to it.

How is Car Fringe Benefits Tax Calculated?

FBT on car fringe benefits can be calculated using two methods:

1. The Statutory Method :

- Simpler but may be costlier.

- Assumes 20% of the car’s value is for private use.

- Does not consider actual business use.

- Requires minimal record-keeping.

2. The Operating Cost Method

- Requires a logbook but may lower tax liability.

- Uses actual costs (fuel, maintenance, insurance, depreciation).

- Requires a 12-week logbook to determine the business-use percentage.

- Higher business use = lower taxable amount.

If you use the Operating Cost Method, you must keep a logbook to track the car’s business and private use. Learn more about the calculation method on the ATO website.

Why You Need a Logbook and Odometer Readings

Keeping a logbook and odometer readings helps determine the proportion of business versus personal use of a vehicle. The higher the business-use percentage, the lower the taxable portion of the car’s expenses, reducing your Fringe Benefits Tax (FBT) liability.

For example, consider a car that costs $40,000 with total vehicle expenses of $10,000 for the year:

- With a Logbook (Operating Cost Method): If your logbook shows 75% business use, then only 25% ($2,500) of the expenses would be subject to FBT.

- Without a Logbook (Statutory Method): You would be taxed on 20% of the car’s cost, meaning $8,000 is subject to FBT.

In this scenario, maintaining an accurate logbook significantly reduces the taxable amount and potential FBT liability.

What Needs to Be Recorded in The Logbook?

To meet ATO requirements, your logbook must:

- Cover a continuous period of 12 weeks: This period should represent your typical vehicle usage and only needs to be updated every five years unless your usage changes significantly.

- Record each journey with:

- Date

- Odometer reading at the start and end

- Total kilometers travelled

- Purpose of the trip (e.g., “Meeting with Client at R. Kelly Business Office” or “Office Works Fremantle – Client Meeting M. Jones, 9 Hay Street”)

Keep start and end odometer readings for the financial year (April 1 – March 31).

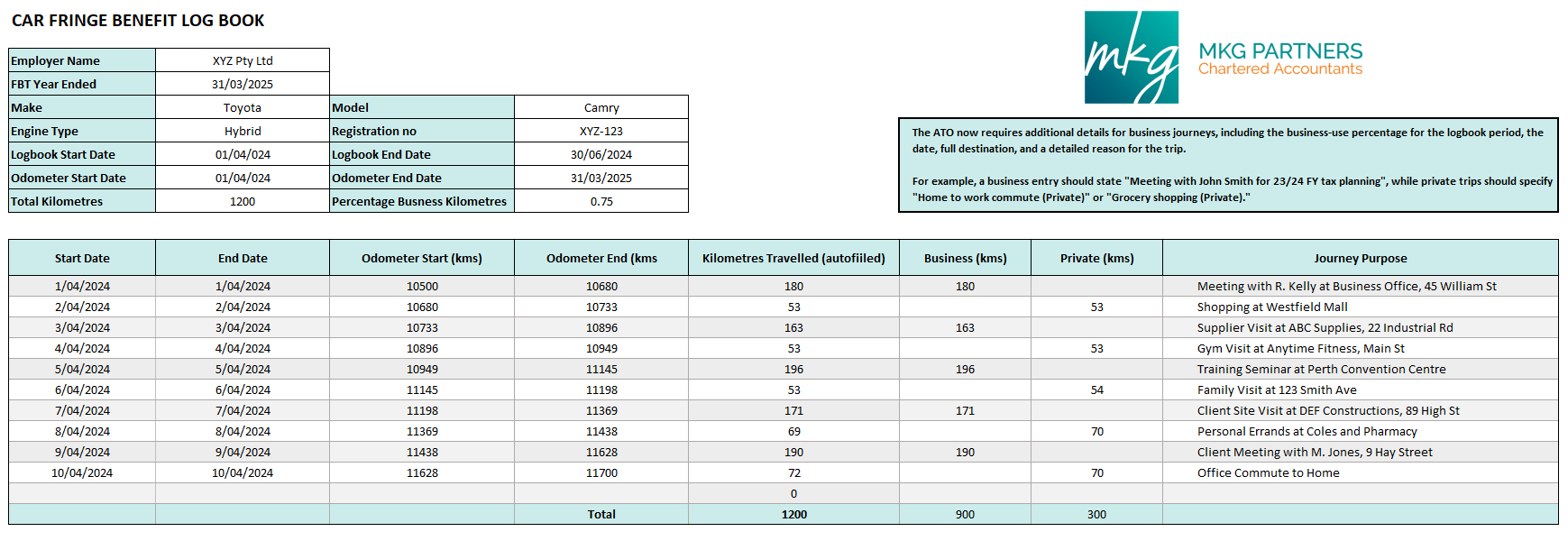

Example of a Logbook Entry

Summary of the Logbook Period

-

Total Kilometers Driven: 1,200 km

-

Total Business Kilometers: 900 km

-

Total Private Kilometers: 300 km

-

Business Use Percentage: 75%

You can download a copy of the log book template here.

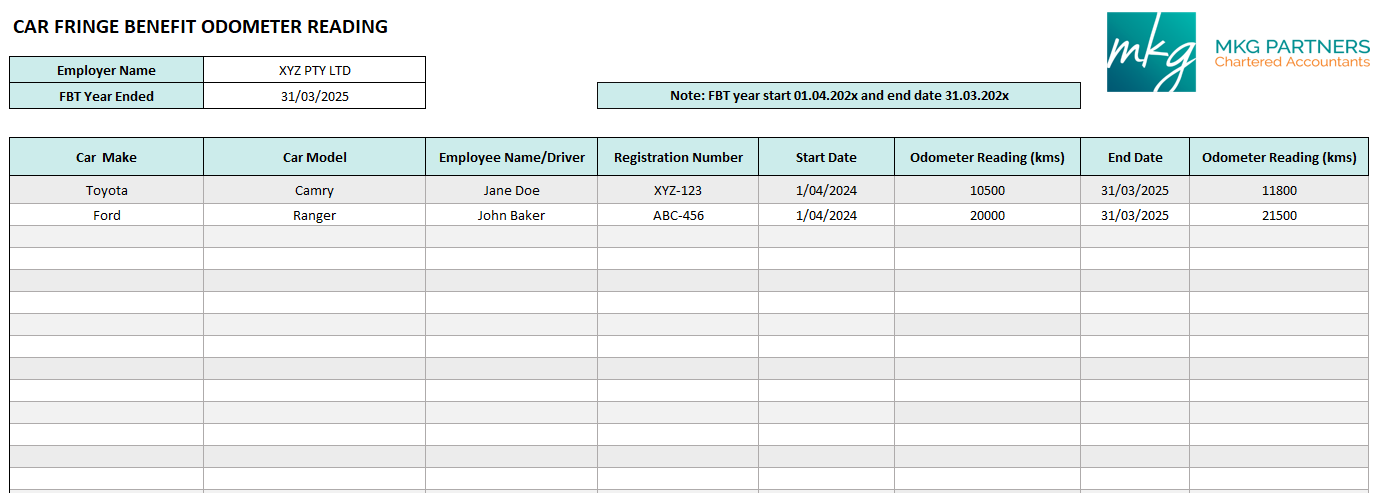

What Needs to Be Recorded Odometer Reading?

If you’re maintaining a logbook to determine a car’s business use, you must also record odometer readings throughout the 12-week logbook period.

An odometer record can cover multiple vehicles, with each car’s details recorded separately within the logbook period to ensure accurate tracking.

Example of Odometer Reading entry

You can download a copy of the odometer reading template here.

Digital Logbooks – A Simpler Alternative

If keeping a paper logbook sounds like a hassle, you can use ATO-compliant digital logbooks to track trips automatically:

- MyDeductions App (ATO’s official tool)

- Get it on Google Play

- Get it on Apps Store

These apps help record your trips without manual entries, making tax time easier.

If you’re unsure about the best method for your business or need help setting up a logbook, MKG Partners is here to assist. Our team can review your records for ATO compliance and help you minimise tax on car fringe benefits. Get in touch today to ensure your business stays compliant while keeping tax costs low!