Maximising tax deductions when renting out your home

Renting out part or all of your house or unit can be a lucrative way to earn extra income. However, to make the most of your rental earnings and stay on top of your taxes, it’s crucial to understand the key points involved.

Declaring rental income

Any payments you receive from renting out your property count as assessable income. This means you must declare the rental income in your tax return, regardless of who registers on the platform. Income is declared by the property owners based on their ownership or lease interest.

Keeping detailed records

To ensure a smooth tax process, maintain detailed records of:

- Statements from platforms showing your rental income including:

- All earnings before fees and commissions

- Insurance payouts for damage caused by renting

- Any bonds or security deposits that you are entitled to retain.

- Cancellation fees

- Receipts for any expenses you wish to claim deductions for.

- Capital Gains Tax (CGT)

Remember, renting out any part of your property may impact your Capital Gains Tax (CGT) main residence exemption when you eventually sell the house or unit. It’s essential to be aware of potential CGT implications and plan accordingly.

Deductions you can claim

Common expenses you can claim a portion of as deductions include:

- Council rates

- Interest on a loan for the property

- Electricity and gas

- Property insurance

- Cleaning and maintenance costs (including products used or hiring a commercial cleaner)

- You may also be able to claim 100% of fees or commissions charged by the rental platform.

Apportioning deductions

When claiming deductions for associated expenses, you need to apportion them based on two factors:

- The time the room or property is rented or occupied for payment.

- The portion of the property that is rented out (e.g. a room or the entire property).

Apportioning expenses for partial rentals

If you’re only renting part of your home, like a single room, you cannot claim the total amount of expenses. Instead, you’ll need to apportion the expenses for both private and income-producing use. A general guide is to apportion expenses based on the floor-area solely occupied by the renter and add a reasonable amount based on their access to common areas.

Renting out part of your home

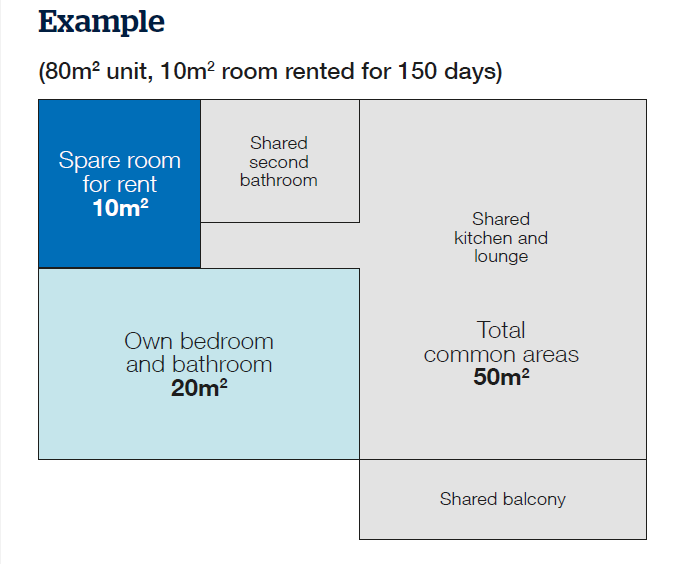

Example:

Jane has a two-bedroom unit with two bathrooms in a popular downtown area. She lives alone and uses one bedroom and bathroom for herself, while the other bedroom and bathroom are not frequently used and mostly kept for guests and storage.

Jane decides to rent out the spare room using a digital platform to earn extra income. The total size of her unit is 80 square metres, and the room being rented is 10 square metres.

Guests who rent the room also have access to common areas like the second bathroom, kitchen, living area, and balcony, which altogether amount to 50 square metres. They can also use her Wi-Fi for free.

The room is occupied by paying guests for 150 days in the year.

To calculate the portion of her expenses she can claim, Jane considers two factors:

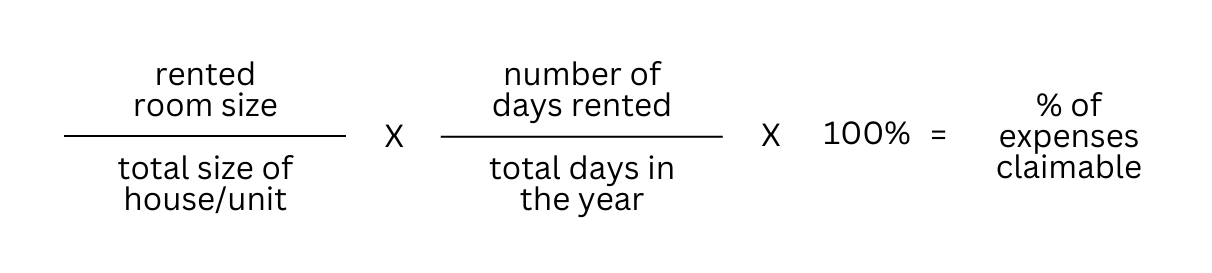

- The proportion of the unit’s space used for renting the room: 10 square metres out of 80 square metres = 10/80 = 0.125 (12.5%).

- The proportion of time the room is rented out: 150 days out of 365 days = 150/365 ≈ 0.411 (41.1%).

Based on these calculations, Jane can claim 12.5% (room occupancy) × 41.1% (time rented) ≈ 5.13% for her general expenses related to the rented room.

Calculation for Rented room (claim 100% for days rented)

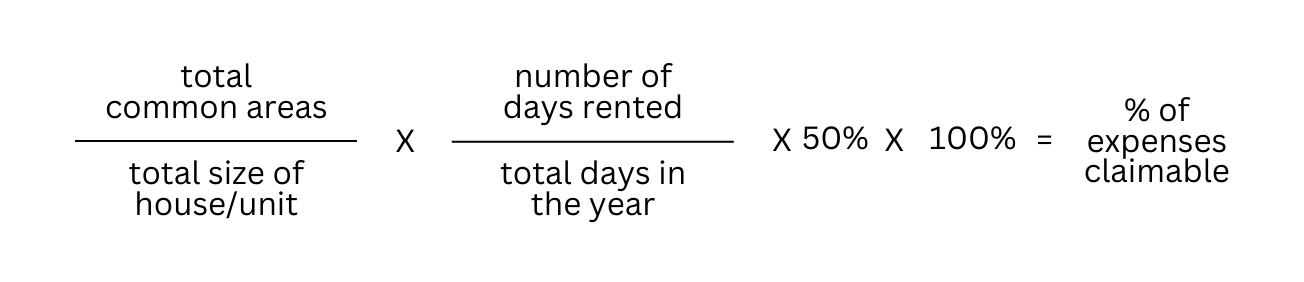

Additionally, for the common areas that guests have access to, she can claim 50% of the portion used by guests, which is 50 square metres out of 80 square metres = 50/80 = 0.625 (62.5%), and then multiply this by the time rented (41.1%) to get 0.625 × 41.1% ≈ 12.84%.

Calculation for Common areas (claim 50% for days rented)

In total, Jane can claim 5.13% (room expenses) + 12.84% (common areas expenses) ≈ 17.97% of her general expenses, such as electricity, mortgage interest, rates, and body corporate fees.

Furthermore, Jane can claim 100% of the expenses directly associated with renting out the room, such as the service fees or commission charged by the digital platform she uses.

Renting out your main residence on occasional basis

Example:

John and Mary live in a one-bedroom unit in the city, which they list as available for rent on a digital platform for paying guests. When John and Mary accept a booking for their unit, they stay with Mary’s parents.

Because the unit is John and Mary’s main residence, and they only vacate the place when there’s a booking, they can only claim expenses based on the time that it was rented out.

Last year, John and Mary rented out the unit for 100 nights. This means they can claim 27.93% of expenses (100 ÷ 365 × 100%).

John and Mary can claim 100% of the expenses associated solely to renting out the unit, such as the platform’s service fees or commission.

Disclaimer: The examples provided above is taken from the Australian Taxation Office (ATO) as a reference for tax planning and compliance. For the original source and more information, please visit the ATO website.

At MKG Partners, we understand the importance of both maximising your tax deductions and ensuring compliance with tax regulations. Our team at MKG Partners can work with you through your rental income to ensure that the correct claims are made, maximising your tax savings. Contact us now.