Rise in income thresholds for Medicare Levy Surcharge increase after 8 year freeze

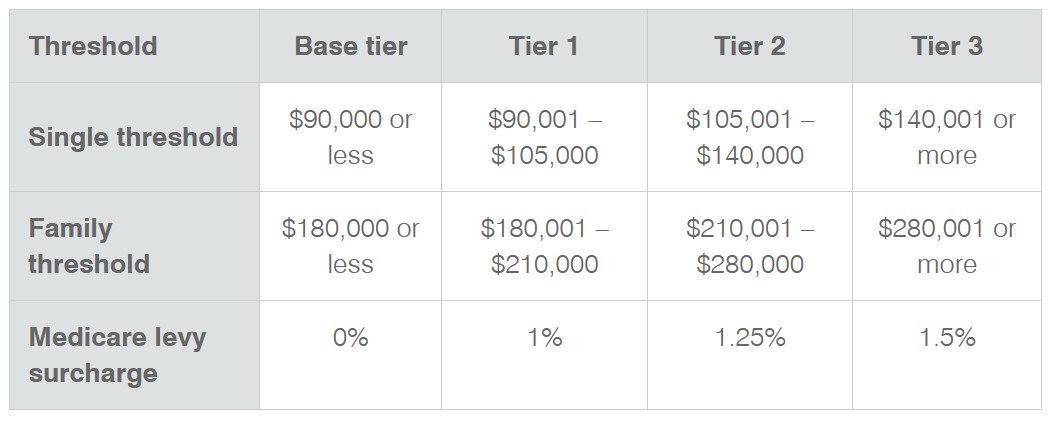

According to ATO, MLS income thresholds and rates from 2014–15 to 2022–23 are as follows:

The family income threshold is increased by $1,500 for each MLS dependent child after the first child.

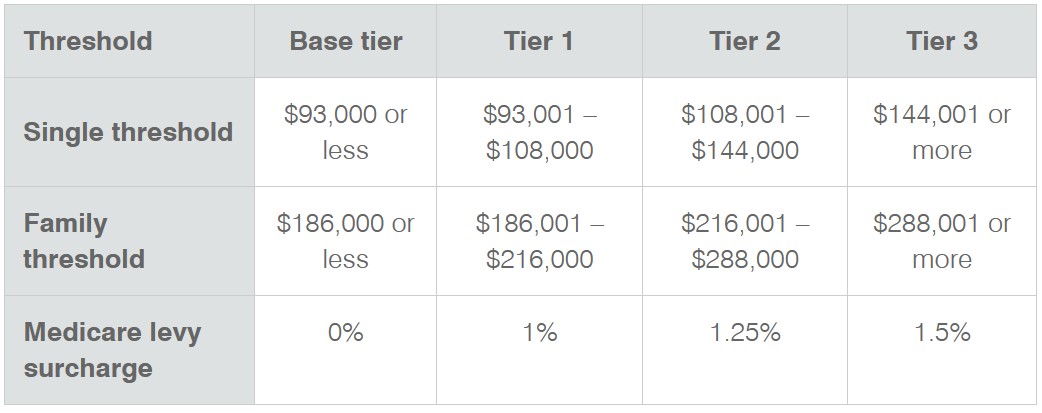

According to ATO , MLS income thresholds and rates for 2023–24 are as follows:

The family income threshold is increased by $1,500 for each MLS dependent child after the first child.

-

- include the net amount on which family trust distribution tax has been paid

- don’t include any assessable first home super saver (FHSS) released amount for the income year under the FHSS scheme.

2. Reportable fringe benefits

3. Net investment losses

-

- include the net amount on which family trust distribution tax has been paid

- don’t include any assessable first home super saver (FHSS) released amount for the income year under the FHSS scheme.

4. Reportable super contributions

-

- reportable employer super contributions

- deductible personal super contributions.

5. If you have a spouse, their share of the net income of a trust on which the trustee must pay tax (under section 98 of the Income Tax Assessment Act 1936) and which has not been included in their taxable income.

you may be able to reduce your income for MLS purposes by any taxed element of the super lump sum, other than a death benefit, that does not exceed your low-rate cap If you meet both of the following conditions:

- you or your spouse must be aged from your preservation age to under 60 years old

- you or your spouse received a super lump sum.

Our team of experienced accountants at MKG Partners can help you navigate the complexities of the Medicare Levy Surcharge and ensure that you are meeting your obligations. Contact us today to learn more about how we can help you.