Navigating EOFY with ease using Xero Payroll

The end of the financial year (EOFY) is just around the corner, and it’s time to get organized. One crucial aspect of EOFY is finalizing your payroll, especially this year with the introduction of Single Touch Payroll (STP) Phase 2 reporting in Xero Payroll. To help you navigate this process smoothly, we’ve outlined the essential steps below:

Step 1

Check your employees’ records:

With the new STP requirements, it’s vital to ensure that your employees’ records are up to date in Xero. This includes verifying employment types, income types, and tax scales for all active and terminated employees.

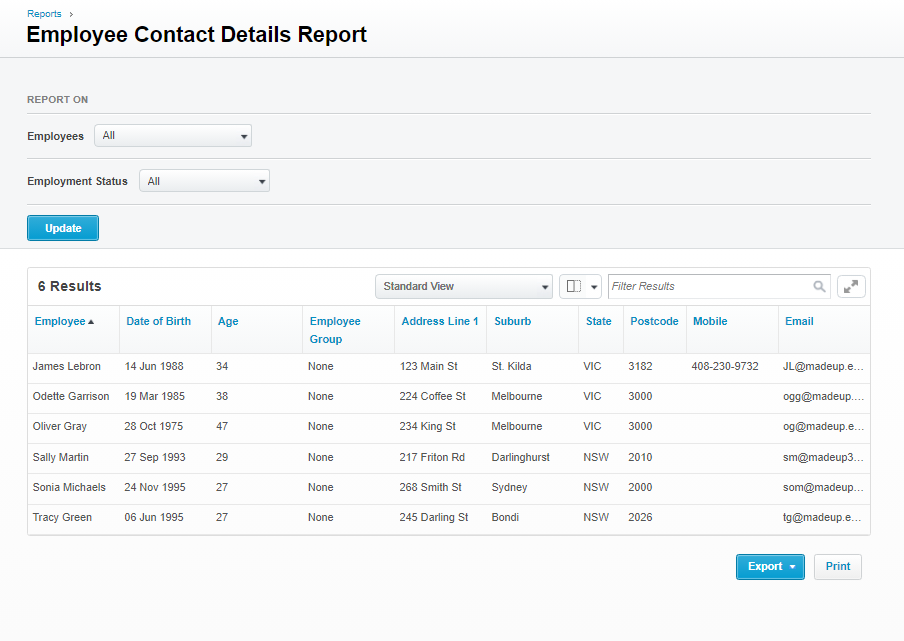

Review your employee’s contact details report by going to Accounting Menu > Reports > Employee Contact Details, use the toggle boxes to select “all” for Employees and Employment Status and then click on the “update” button.

Xero’s Employee Contact Details Report page

Step 2

Review pay items and their settings:

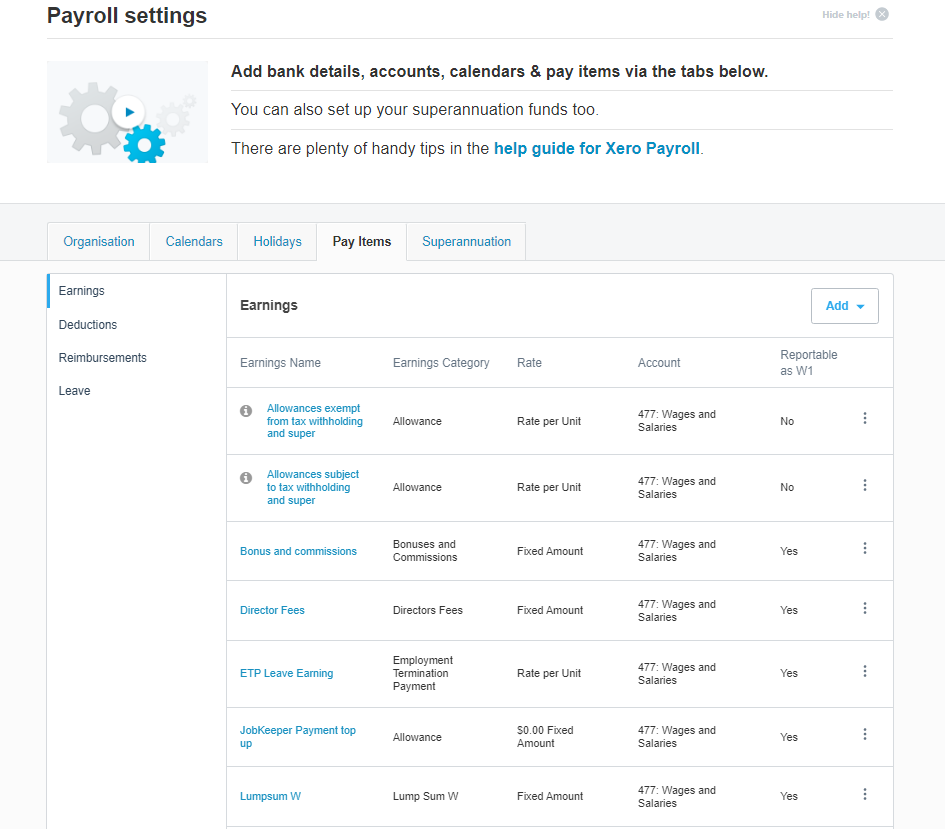

STP Phase 2 introduced new reporting categories for earnings, deductions, paid leave, and allowances. It’s important to review and assign the correct reporting types to your pay items to comply with ATO regulations.

You can get to the pay items page by navigating to Payroll > Payroll Settings > Pay items. Use these links to visit Xero Central for more details on reporting categories and ATO’s reference guide on how to report common payment types through STP Phase 2.

Xero pay Items tab in payroll settings

Step 3

Post and file pay runs for the current financial year:

Any pay runs with a payment date in this financial year must be posted and filed before finalizing your employees. Ensure that all pay runs have been successfully filed to the ATO using STP.

Step 4

Process outstanding superannuation payments:

To claim a deduction on superannuation accruals, superannuation must be paid by the cut off date of 28th July 2023. If you’re not registered for auto super, you can still make manual payments outside of Xero.

Step 5

Reconcile your payroll accounts:

After processing all pay runs, it’s essential to reconcile your payroll accounts and check for accuracy. Use the Payroll Activity Summary report (Accounting > Reports > Payroll Activity Summary) and compare it with the General Ledger report (Accounting > Reports > General Ledger Summary Report).

If you identify any discrepancies, use the remove and redo feature to correct the transactions.

(Out of balance payroll accounts can be a bit tricky – contact our team if you need some help!)

Step 6

Review the Payroll Activity Summary report against the Payment Summary Details report:

Compare the Payroll Activity Summary report (Accounting > Reports > Payroll Activity Summary) and the Payment Summary Details report (Accounting > Reports > Payment Summary Details).

Handy Hint: Remember that the Payroll Activity Summary report shows gross earnings, while the Payment Summary Details report shows taxable earnings. Adjust gross wages if there are salary sacrifices or pre-tax deductions.

Step 7

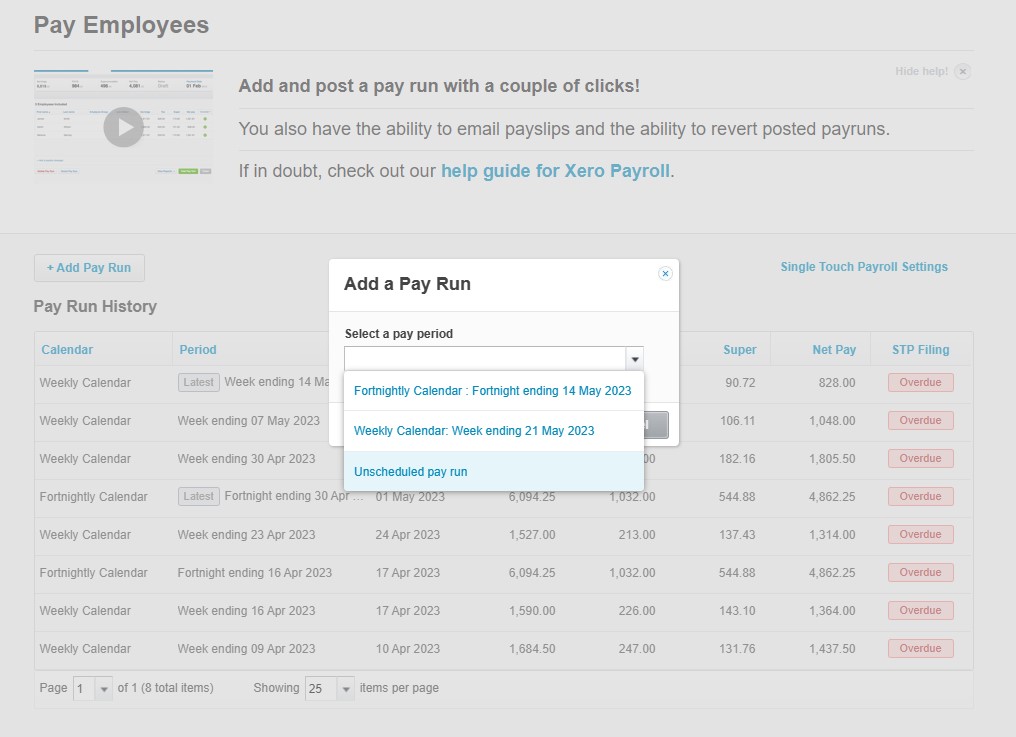

Identify and amend any mistakes:

Correct any errors made throughout the financial year by processing an unscheduled pay run. Ensure the payment date falls within the correct financial year for accurate reporting.

Xero Unscheduled Payrun

Step 8

Process STP finalization:

Finally, it’s time to process your STP finalization. Familiarize yourself with the steps provided by Xero to finalize your payroll information with the ATO. Remember to file at least one pay run before completing the STP finalization process.

By following these steps, you can ensure a seamless EOFY in Xero Payroll.

For expert assistance and guidance throughout the EOFY process, our team of experienced professionals at MKG Partners can provide personalised support and ensure a seamless transition into the new financial year.