Upcoming Changes to Marginal Tax Rates Starting 1 July 2024

With the next financial year on the horizon, there are important changes coming to the Australian tax system that warrant attention. Set to take effect from 1 July 2024, the Australian Taxation Office (ATO) has announced significant amendments to the marginal tax rates. Although these changes are several months away, understanding them now is crucial for effective financial planning.

Key changes of the New Marginal Tax Rates:

The ATO’s revisions are part of a broader strategy to reform the tax system. The key changes are as follows:

Tax-Free Threshold Remains Unchanged: The tax-free threshold remains at $18,200, meaning no tax for annual incomes up to this amount.

Adjustment in Lower Income Brackets: For incomes between $18,201 and $45,000, the tax rate is 19 cents for every dollar over $18,200.

Significant Middle Bracket Changes: A major shift occurs in the middle-income bracket. Now, incomes between $45,001 and $200,000 will be taxed at $5,092 plus 30% for every dollar over $45,000.

Upper Income Bracket Rate: For incomes exceeding $200,001, the tax rate is $51,592 plus 45 cents for each dollar over $200,000.

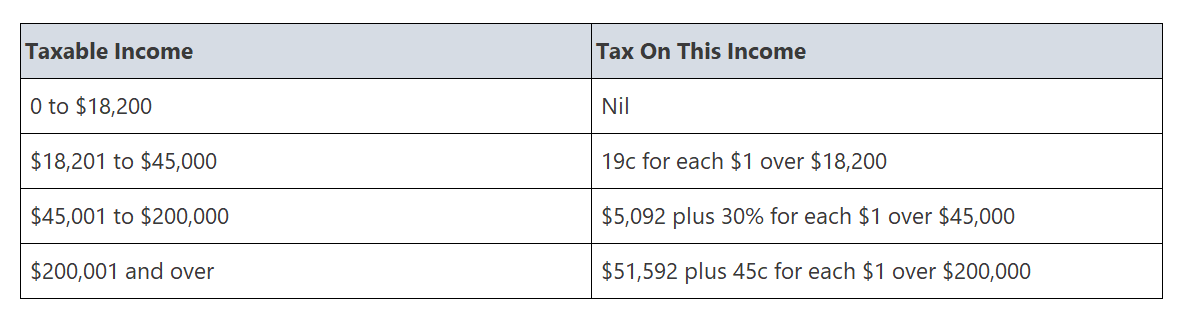

2024-25 Tax Scale Table:

To give you a clearer picture, here is the “Tax scale 2024-25” table detailing these rates:

The above tables do not include the 2% Medicare Levy or the effect of any Low Income or Low and Middle Income tax offsets.

Impact of the Tax Rate Changes:

- Lower-Income Earners: Those earning up to $45,000 will see minor changes in their tax obligations. The increase in the tax rate threshold from $18,200 to $45,000 with a consistent rate of 19% is beneficial, though its impact might be relatively modest.

- Middle-Income Earners: Individuals within this bracket will likely experience the most significant changes. The expansion of the 30% tax bracket up to an income of $200,000 aims to provide substantial tax relief, potentially increasing disposable income and financial stability for many.

- High-Income Earners: For those earning above $200,000, the changes result in a continued high tax rate (45%). However, these individuals will also benefit from the extended 30% bracket, as their initial $200,000 will be taxed at a lower rate than before.

Calculating Your Tax Under the New Marginal Tax Rates:

Understanding how to calculate your tax liability under the new tax scales is crucial for effective financial planning. Here’s a simple guide to help you determine your tax payable:

Identify Your Income Bracket:

First, determine which income bracket you fall into. The brackets for the 2024-2025 financial year are as follows:

-

- $0 to $18,200

- $18,201 to $45,000

- $45,001 to $200,000

- Over $200,001

2. Calculate Tax for Each Bracket:

- For incomes up to $18,200: No tax is payable.

- For incomes from $18,201 to $45,000: Calculate 19% of the amount over $18,200.

- For incomes from $45,001 to $200,000: Calculate $5,092 plus 30% of the amount over $45,000.

- For incomes over $200,001: Calculate $51,592 plus 45% of the amount over $200,000.

Example Calculation 1:

- Assume an annual income of $30,000.

- This income falls into the second bracket ($18,201 to $45,000).

- Taxable amount = $30,000 – $18,200 = $11,800.

- Tax payable = 19% of $11,800 = 0.19 x $11,800 = $2,242.

Example Calculation 2:

- Assume an annual income of $100,000.

- This income falls into the third bracket ($45,001 to $200,000).

- Taxable amount over $45,000 = $100,000 – $45,000 = $55,000.

- Tax payable = $5,092 plus 30% of $55,000 = $5,092 + (0.30 x $55,000) = $5,092 + $16,500 = $21,592.

Above’s calculations does not include other factors like the Medicare Levy or tax offsets, which can further adjust the final tax amount.

Effective Tax Rate:

- To find the effective tax rate, divide the tax payable by your total income.

- In our example, the effective tax rate = ($2,242 / $30,000) x 100 ≈ 7.47%.

This calculation method gives you a clear understanding of how much tax you’ll need to pay based on your annual income

Additional Factors Influencing Your Final Tax Payable:

While understanding the marginal tax rates is crucial, it’s important to remember that several other elements can affect your final tax payable. These include:

1. Medicare Levy:

Most taxpayers in Australia are required to pay a Medicare Levy, which is an additional 2% of your taxable income. However, there are thresholds and exemptions based on income, family status, and specific medical conditions.

2. Low and Middle Income Tax Offset (LMITO):

Depending on your income level, you may be eligible for LMITO, which can reduce the amount of tax you owe.

3. Deductions and Tax Credits:

Various deductions (e.g., work-related expenses, charitable donations) and tax credits can be applied to reduce your taxable income, thereby affecting the final tax payable.

4. Superannuation Contributions:

Contributions to your superannuation can have tax implications, potentially lowering your taxable income.

5. Investment Income and Losses:

Any income earned from investments or losses incurred can impact your overall tax situation.

Each individual’s tax situation can vary significantly based on these and other factors.

Navigating the complexities of the upcoming 2024-25 tax changes can be challenging, but you don’t have to face it alone. At MKG Partners, our team of seasoned tax professionals is ready to offer personalised advice and strategies tailored to the new regulations. Whether you’re seeking to optimise your tax situation or need clarity on how these changes impact you or your business, we’re here to help. Contact MKG Partners today for a consultation and ensure you’re well-prepared for the future.