Xero Payroll EOFY Checklist

As we approach the EOFY, it’s not just about wrapping up another financial year; it’s about setting a solid foundation for the next. For many of us, this means ensuring our payroll systems are not only compliant but streamlined for efficiency, especially with the introduction of STP Phase 2 reporting in Xero. If the thought of navigating through these changes feels overwhelming, rest assured, you’re not alone. Our checklist is here to provide clarity and support, ensuring you step into FY25 with confidence and your payroll in perfect order.

1. Aligning with STP Phase 2 Requirements

Ensuring Employee Records are Accurate

Accuracy in employee records is the cornerstone of STP Phase 2 compliance. Take the time to review and confirm that employment types, income types, and tax scales are correctly updated in Xero for all employees. This step is crucial for a smooth transition into the new financial year, ensuring that every detail is accounted for.

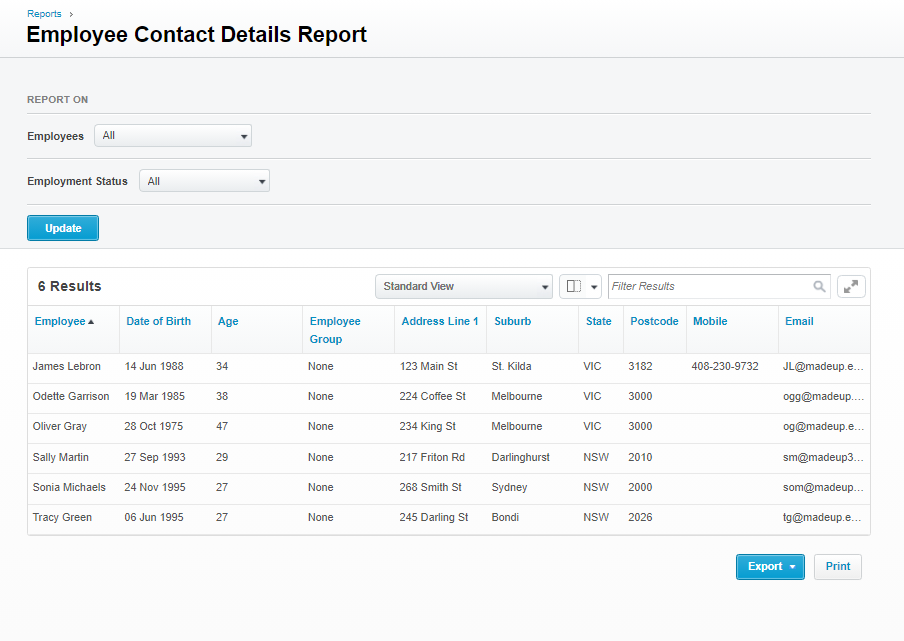

To review your employee’s contact details, go to Accounting Menu > Reports > Employee Contact Details, use the toggle boxes to select “all” for Employees and Employment Status and then click on the “update” button.

Xero’s Employee Contact Details Report page

Reviewing Pay Items for Compliance

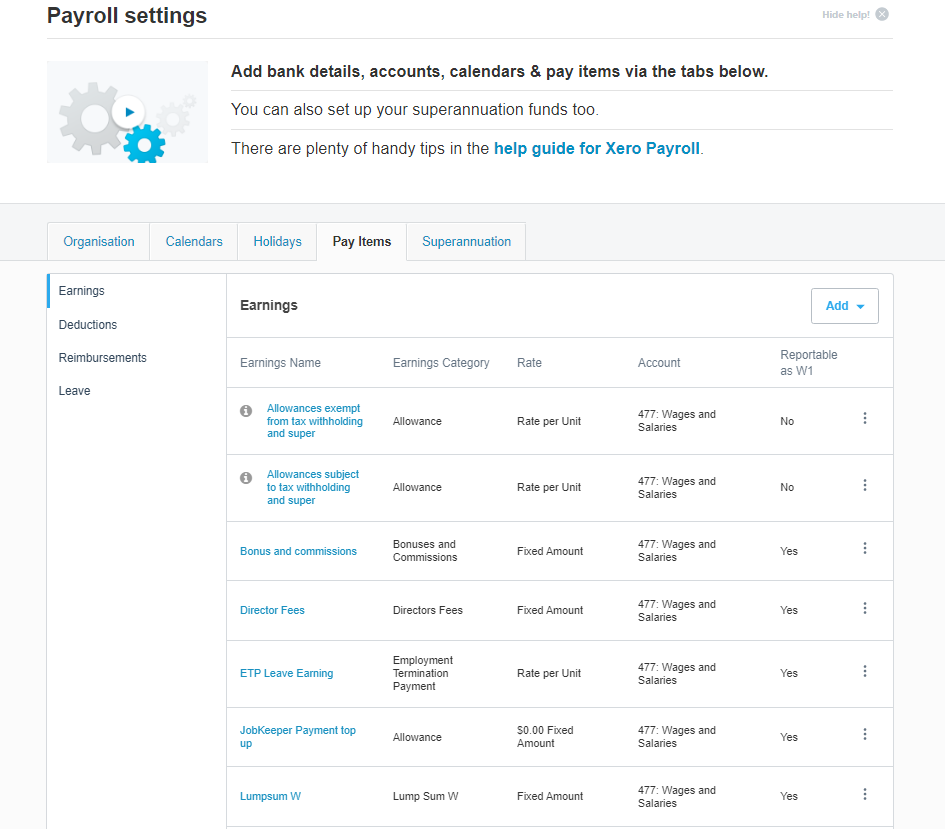

With the introduction of new reporting categories by the ATO under STP Phase 2, it’s important to ensure that your pay items are properly classified. This means assigning the correct categories to earnings, deductions, and allowances to meet ATO requirements. A thorough review now can prevent compliance issues down the line.

You can get to the pay items page by navigating to Payroll > Payroll Settings > Pay items. Use these links to visit Xero Central for more details on reporting categories and ATO’s reference guide on how to report common payment types through STP Phase 2.

Xero pay Items tab in payroll settings

2. Finalising Your FY24 Payroll

Posting and Filing Pay Runs

As the EOFY draws near, it’s imperative to post and file all relevant pay runs up to 30 June. This not only ensures compliance but also paves the way for a seamless reporting process to the ATO. Ensure every pay run is accounted for and successfully filed through STP, setting the stage for a smooth year-end closure.

Managing Superannuation Payments

The timely processing of superannuation payments is not just a compliance requirement; it’s an opportunity to optimise deductions. Whether you’re utilising auto-super features or making manual payments, ensure they are completed by the ATO’s deadline to fully benefit from available deductions.

To claim a deduction on superannuation accruals, superannuation must be paid by the cut off date of 28th July 2024. If you’re not registered for auto super, you can still make manual payments outside of Xero.

3. Preparing for a Seamless Transition to FY25

Reconciling Payroll Accounts

A key part of the EOFY process is reconciling your payroll accounts. This involves a detailed review of payroll transactions against the general ledger to identify any discrepancies. Addressing these early on ensures the integrity of your financial reporting and lays a clean slate for the new financial year. Use the Payroll Activity Summary report (Accounting > Reports > Payroll Activity Summary) and compare it with the General Ledger report (Accounting > Reports > General Ledger Summary Report).

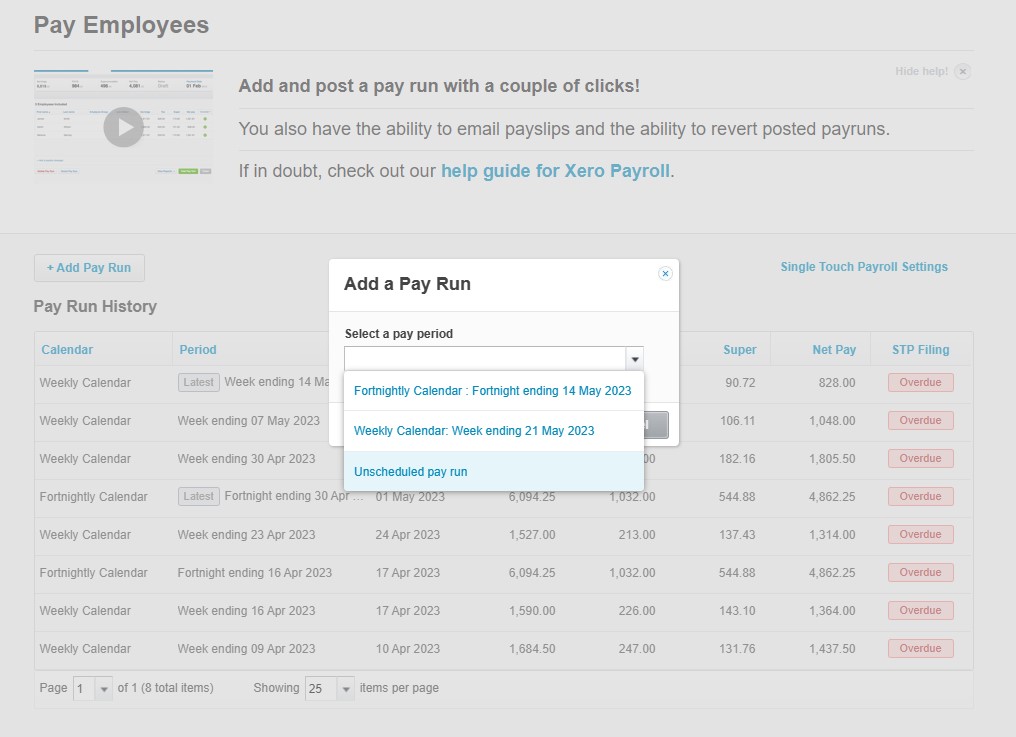

Rectifying Errors and Completing STP Finalization

Should you discover any discrepancies or errors, now is the time to correct them through unscheduled pay runs. Once corrections are made, proceed with the STP finalization process. This final step is critical for ensuring your payroll records are accurately reported and fully compliant with ATO regulations.

Xero Unscheduled Payrun

As we look forward to FY25, it’s essential to stay informed about any changes that could impact your payroll, such as updates to the Super Guarantee rate or minimum wage adjustments. Staying proactive in these areas ensures not only compliance but also avoids the last minute scramble to meet deadlines.

Need expert guidance or support with your EOFY payroll preparation in Xero? Our team at MKG Partners is here to help. Contact us today for personalised assistance and ensure a smooth transition into the new financial year.