2024-25 Federal Budget Analysis: Key Changes and What They Mean for You

Welcome to our detailed breakdown of the 2024 Federal Budget. This year, Treasurer Jim Chalmers has introduced a series of measures aimed at enhancing economic resilience, particularly for small to medium-sized enterprises (SMEs). Understanding these changes is essential for effective planning and financial management as we transition into the new fiscal year. Let’s explore the implications for individuals, businesses, and superannuation, and discuss how you can leverage these developments for a successful financial year ahead.

For Individuals

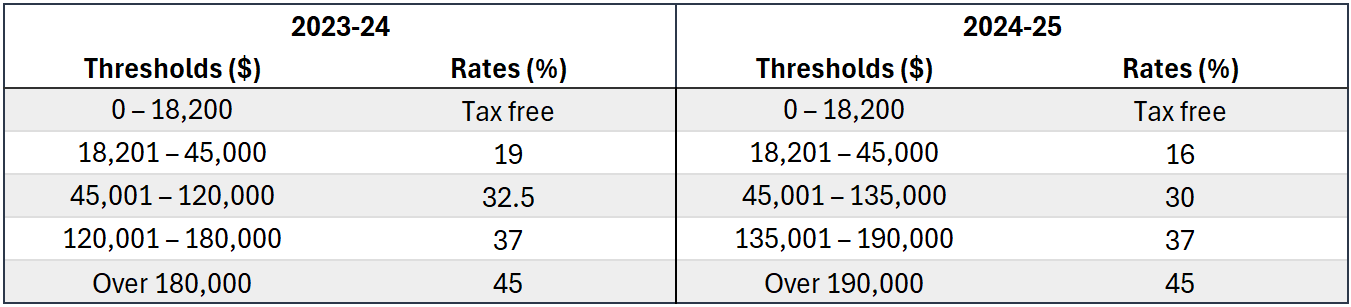

Effective from July 1, 2024, the government is implementing significant tax relief by adjusting income tax brackets:

- The 19% tax bracket will be lowered to 16% for incomes between $18,201 and $45,000.

- The 32.5% bracket will be reduced to 30% for incomes between $45,001 and $120,000.

- Threshold adjustments include raising the 37% tax bracket from $120,000 to $135,000, and the top 45% bracket from $180,000 to $190,000. These changes aim to increase take-home pay, boosting consumer spending and providing extra liquidity for personal investment.

- Visit The Treasury for detailed fact sheets.

Pesonal tax rates and thresholds for 2024-25

*Rates do not include Medicare levy of 2% as applicable.

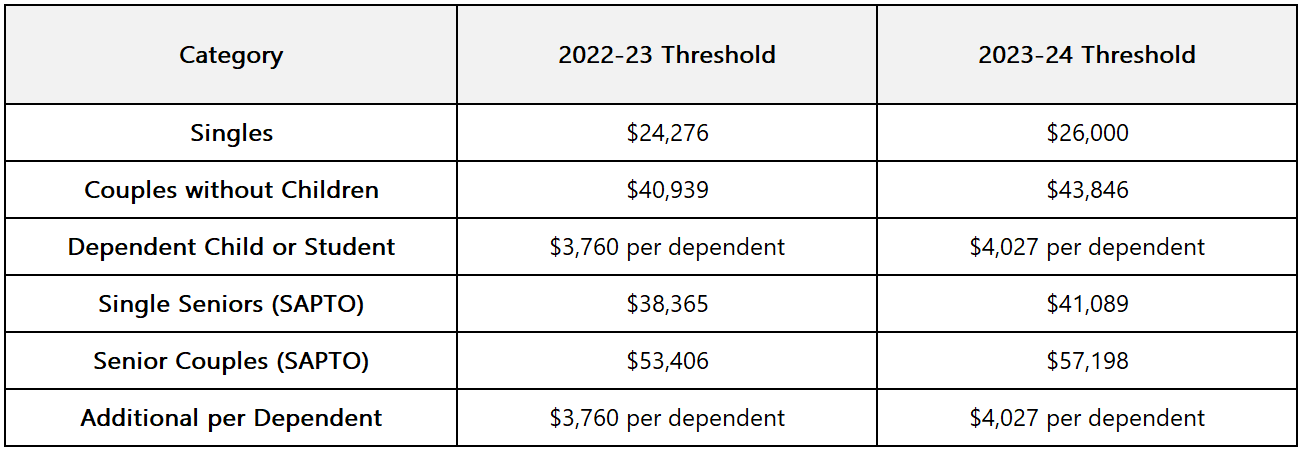

As part of the recent Federal Budget, there have been significant increases in the low-income thresholds for the Medicare levy. These adjustments are designed to reduce the tax liability for individuals and families earning below these new thresholds, thus decreasing the overall tax burden on lower-income earners.

Updated Medicare Levy Low-Income Thresholds for the 2023-24 Income Year

These changes reflect the government’s commitment to alleviating the financial strain on vulnerable populations, especially in light of economic challenges and rising living costs. By increasing these thresholds, more Australians will be exempt from paying the Medicare levy, leaving them with more disposable income to manage their daily expenses and financial obligations. This is a crucial step in supporting those on the lower end of the income spectrum, ensuring they are less burdened by unavoidable taxes.

A direct rebate of $300 will be provided to each household to help offset rising utility costs, directly affecting the monthly budget of millions of Australians.

For Businesses

The extension of the instant asset write-off for assets under $20,000 until June 30, 2025, provides SMEs with an incentive to invest in new and efficient tools and technology. This measure is designed to improve productivity and stimulate economic activity within the SME sector.

Small businesses will benefit from a $325 rebate on their electricity bills from July 1, 2024, which helps reduce the operational costs associated with rising energy prices.

You may access the full budget 2024-25 documents here for more information.

For Superannuation

Introducing an additional 15% tax on the earnings from super balances over $3 million, effective from July 1, 2025. This measure is targeted at ensuring that the superannuation tax concessions are more equitably distributed among taxpayers.

The superannuation guarantee rate will incrementally increase from the current 10.5% to 11% by July 1, 2024, followed by another increase to 11.5% in July 2025, and reaching 12% by July 2026. This gradual increase ensures that employers and employees can adjust financially over time.

The annual superannuation contribution caps will be raised from $27,500 to $30,000, regardless of the contributor’s age. This increase allows individuals to contribute more money into their superannuation accounts each year.

The 2024-25 Federal Budget presents a pragmatic approach to economic management, providing targeted relief to those in need while fostering an environment conducive to growth and stability. As always, we are here to assist you in understanding these changes and integrating them into your financial planning. Reach out to our expert accountant for personalised advice and support.