2025 Recordkeeping Essentials for Home Office Tax Claims

If you’re working from home in 2025, whether as a sole trader or employee, good recordkeeping is more important than ever. The ATO has signalled that home office claims are under closer scrutiny, and without proper documentation, even well-intentioned deductions can be disallowed.

In this guide, we walk through the key records you should be keeping, how to track them throughout the year, and how long to store them to remain ATO-compliant. If you haven’t seen it already, read our ATO Focus Areas for 2025 blog to understand why getting this right matters more than ever.

Work-from-Home Hours

If you’re using the fixed rate method (70 cents per hour), the ATO requires:

-

A four-week representative diary to show your usual pattern of hours worked from home

-

A 12-month log of total hours for the year

Accepted formats include spreadsheets, digital calendars, or time-tracking apps. If your employer has a formal remote work policy, keep a copy for your records. You can learn more about the ATO’s expectations in their home office deductions guide.

Phone and Internet Usage: Tracking Business Use

To claim a portion of your mobile phone or internet, you must:

-

Keep monthly bills

-

Maintain a four-week diary showing business vs personal use

-

Apply the business-use percentage to your expenses

For example, if 70% of your internet usage supports work activity, document that calculation clearly. If you’re using Hubdoc, scan and attach these bills, and sync them with Xero for easy access.

For more, refer to the ATO’s guide on phone, data and internet expenses.

Equipment, Tools and Office Furniture: Keep Your Receipts

When you purchase work-related equipment such as a computer, desk, printer, or ergonomic chair, you should:

-

Retain the purchase receipt

-

Record the business-use percentage if it is shared

-

Determine whether to claim the item immediately or via depreciation, depending on its cost and your setup

If you use Xero and Hubdoc, scan and attach the receipt to your transaction for cleaner recordkeeping. For reference on thresholds and eligible items, see the ATO’s overview of depreciation and capital allowances.

Occupancy Costs (Sole Traders Only)

If you operate your business from home and your home is your principal place of business, you may be able to claim:

-

A percentage of mortgage interest or rent

-

Council rates, home insurance, and water bills

To support this claim, you need to prepare:

-

A simple floor plan of your home highlighting your office space

-

A calculation of the business-use percentage, usually based on the floor area used

These occupancy deductions are generally not available to employees. You can find more detail on eligibility in the ATO’s page on home office occupancy expenses.

Running Expenses: Power, Cleaning and More

If you work from home, you can also claim a portion of your running costs such as:

-

Electricity and gas bills

-

Cleaning costs for your work area

-

Minor repairs and maintenance of your home office space

To calculate your claim, determine the business-use percentage and keep all relevant bills and receipts. You can base the percentage on time spent working, room size, or a combination of both.

For accepted calculation methods, refer to the ATO’s information on home office running expenses.

Motor Vehicle Use: If You Travel for Business

f your home is your primary base of operations and you use your car to travel for business purposes, such as attending client meetings or picking up supplies, you can claim car-related expenses.

To do this, you must:

-

Keep a 12-week logbook that includes the date, destination, reason for travel, and odometer readings

-

Calculate the business-use percentage of your car

-

Retain fuel, maintenance, and registration receipts

Logbook records must be detailed, consistent, and kept for five years. If you’re not sure what a compliant logbook looks like, or if you want to download a ready-to-use template, visit our full guide on Car Fringe Benefits and Logbooks. It explains both employee and business use cases, includes ATO examples, and outlines how to avoid common FBT mistakes.

For general ATO guidance, you can also refer to their page on vehicle and travel deductions.

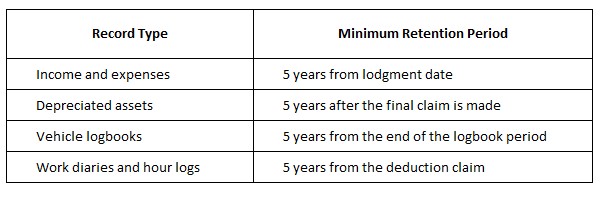

How Long Should You Keep Your Records?

The ATO requires most tax-related records to be kept for five years from the date you lodge your return. This includes receipts, usage diaries, and logbooks. If you claim depreciation on an asset, you must keep the records for five years from your final claim.

You can review the ATO’s retention requirements here.

Tools to Help You Stay Organised

If you’re using Xero, you’re already on the right track. Xero allows you to categorise expenses, attach source documents, and generate real-time reports that simplify your recordkeeping. For managing receipts, Hubdoc integrates seamlessly with Xero, letting you scan, store, and auto-code your bills and receipts directly into your accounting file.

We recommend setting up a cloud storage system (such as Google Drive or Dropbox) for any non-financial documents like work diaries, floor plans, or vehicle logbooks and backing up regularly. For tracking travel, GPS-based logbook apps can help automate the process and ensure compliance.

The key is to choose tools that fit naturally into your workflow and update them consistently throughout the year.

With the ATO tightening its focus on home office deductions and digital record-matching, now is the time to put a solid recordkeeping system in place. Keeping detailed, accurate records throughout the year makes tax time easier and helps ensure that every claim you make is fully supported. At MKG Partners, we help clients build simple systems that work, whether that’s setting up Hubdoc, reviewing Xero files, or preparing for year-end deductions. If you need help getting started or want a second opinion on your current setup, get in touch with our team.