Getting Car Fringe Benefits: When FBT Applies (and When It Doesn’t)

For many employers, providing a vehicle to employees is simply part of doing business. But if not handled carefully, it can quickly become a Fringe Benefits Tax (FBT) headache. With the ATO keeping a close eye on car-related perks, it’s crucial to understand exactly when FBT applies—and when it doesn’t. Let’s take a closer look at what constitutes a car fringe benefit, how to stay compliant, and some common exemptions that could help your business reduce tax obligations.

When Is a Car Considered Available for Private Use?

FBT is triggered primarily when a car is made available for private use. But what exactly does “available” mean?

In the eyes of the ATO, a car is considered available for private use if:

-

It is garaged at the employee’s home — even if the employee doesn’t actually drive it privately;

-

The employee has access to the car for personal trips (even occasionally);

-

It is made available for any private travel (including weekends, holidays, or small errands).

Example: If a work vehicle is parked at an employee’s home overnight, it is automatically considered available for private use, even if the employee only drives it to and from work.

It’s not just about actual use—it’s about potential access. That’s why having a clear policy isn’t enough on its own. Please refer to ATO for more details.

What if Your Policy Says “Business Use Only”?

If your employment contract or internal policy explicitly states that the vehicle is for business use only — that’s a positive first step. But the ATO won’t just take your word for it.

To rely on this and avoid FBT, you must back it up with evidence, such as:

-

Regularly maintained logbooks or GPS logs;

-

Odometer records at the start and end of each FBT year;

-

A clear record that the vehicle is not garaged at home or used on weekends;

-

Proof of minor private use only applies to exempt vehicles like utes and vans. For regular cars, the ATO assumes 100% private use unless you keep a valid logbook and odometer records.

Without this supporting evidence, a written policy on its own won’t be enough to avoid FBT.

When the Car Fringe Benefit Rules Don’t Apply

Not all employer-provided vehicles are subject to car fringe benefit rules. In some cases, FBT doesn’t apply at all—either because:

-

The vehicle doesn’t meet the definition of a “car”;

-

There’s no private use;

-

The employee makes sufficient after-tax contributions to offset the benefit.

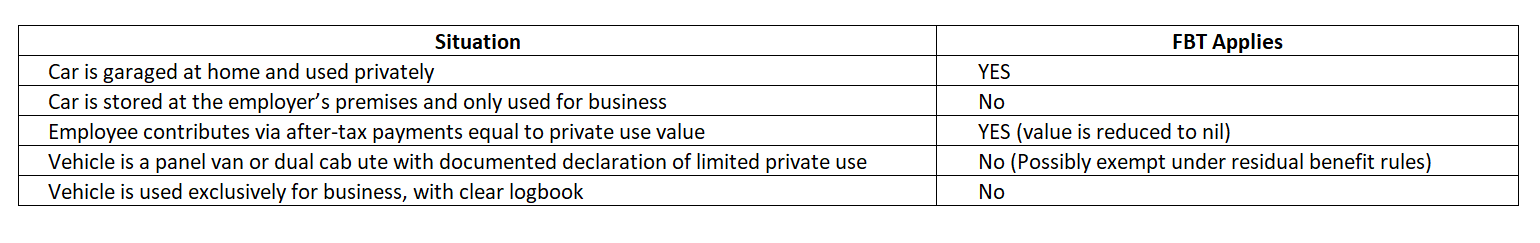

Following are some examples:

Important Developments for Vehicles That Are Not ‘Cars’

To fall under the car benefit category, a vehicle must be designed to carry fewer than nine passengers and a load of less than one tonne.

Vehicles that fall outside this definition include:

-

Dual cab utes or vans used primarily for work;

-

Electric scooters and bicycles;

-

Motorcycles;

-

Heavy vehicles.

When these vehicles are used strictly for business purposes—or if personal use is limited and meets the ATO’s minor and infrequent test—they may qualify for exemptions under the residual benefit rules instead of the standard car benefit provisions.

The ATO has issued updated guidance tightening expectations around documentation for these vehicles. In particular, logbooks, odometer readings, and clear policies are now more critical than ever. Visit our guide to car fringe benefit logbooks and odometer tracking to learn more and get the template to records logbook and odometer reading..

If you’re unsure about the best method for your business, MKG Partners is here to assist. Our team can review your records for ATO compliance and help you minimise tax on car fringe benefits. Get in touch today to ensure your business stays compliant while keeping tax costs low!