Refinancing Tips: How to Save Big on Your Mortgage

You’ve heard the saying “no reward for loyalty,” and nothing could be more truthful when it comes to your home loan. Despite years of faithful payments, sticking with the same bank might not be doing you any favors. In fact, with new residential lenders entering the market and competition being greater than ever before, banks are looking to incentivise new customers to continue their revenue growth.

So, what’s the solution? Refinancing!

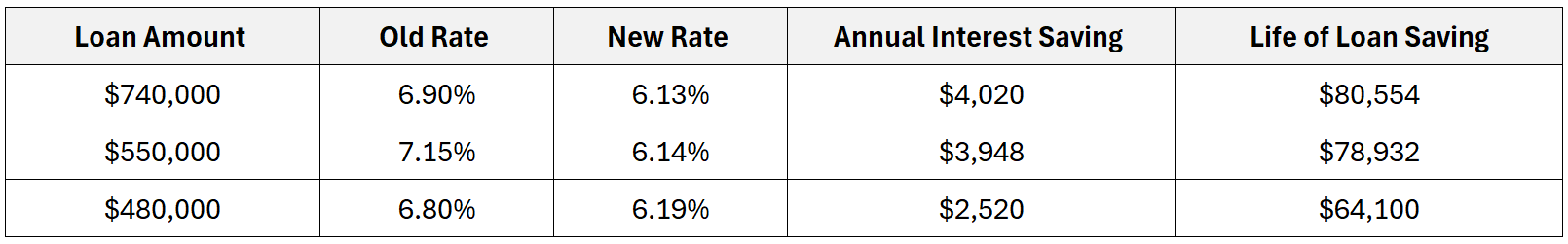

Refinancing your mortgage can open a world of benefits that you may not have considered. With the average Australian mortgage increasing to $615,000 (ABS), even a small reduction in interest rate can have a huge long-term impact. Let’s break down some of the key advantages:

Lower Interest Rates

One of the most obvious benefits of refinancing is the potential to secure a lower interest rate. With the market constantly evolving, there may be new lenders offering more competitive rates than what you’re currently paying. By refinancing, you could significantly reduce your monthly repayments and save thousands in interest over the life of your loan.

Improved Loan Terms

Refinancing also gives you the opportunity to renegotiate your loan terms to better suit your financial situation. Whether you’re looking to switch from a variable to a fixed rate, extend or shorten your loan term, refinancing allows you to tailor your mortgage to your specific needs.

Access to Equity

If the value of your property has increased since you first took out your mortgage, refinancing can give you access to that equity. Whether you want to renovate your home, invest in property, or fund other financial goals, tapping into your home’s equity can provide you with the funds you need to make it happen..

Consolidating Debt

If your personal loans, credit cards, or other debts are causing short-term cash flow issues, refinancing can be a smart way to consolidate those debts into one simplified repayment.

While it may seem daunting to navigate the world of refinancing, that’s exactly why we’re here! By taking the time to explore your options and crunch the numbers, you could unlock hidden value in your mortgage and put yourself on the path to greater financial freedom.

Contact James at M Finance to organise your refinancing and take the first step toward maximising the potential of your home loan. Remember, when it comes to your mortgage, simplicity is key, and M Finance is here to make it happen.

![HD logo [purple and green]](https://www.mkgpartners.com.au/wp-content/uploads/2024/05/HD-logo-purple-and-green.png)